U.S. Household Appliances Industry Overview

The U.S. household appliances market size was valued at USD 58.33 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030. The rise in people's disposable income levels is expected to be a driving force in the market's expansion. The pace of urbanization is rapidly expanding, which is projected to have a beneficial impact on the household appliances market. COVID-19's rapid spread across the globe posed major issues in the form of supply chain disruptions for most manufacturers, including large home appliances in the United States. Limited component availability, labor shortages, and other supply chain-related issues are some of the primary challenges that most industry players are currently focused on.

Gather more insights about the market drivers, restrains and growth of the U.S. Household Appliances Market

Furthermore, consumers were compelled to reconsider their priorities, adjust their buying patterns, and develop new habits. Consumers are increasingly buying appliances online, according to various reports, as they adopt social distancing. In the case of larger home appliances like refrigerators, stoves, dishwashers, dryers, and the like, the pandemic has had an impact on purchasing behavior. Do-it-yourself pursuits, such as decorating, cooking, sewing, and arts and crafts, have gained popularity among stay-at-home moms.

The market will grow due to various growth drivers such as an increase in single-person households, an increase in disposable income, an increase in the number of smart homes, an increase in the millennial population, an increase in online sales of small household appliances, an increase in the demand for smart sensors, an increase in the demand for energy optimization, and so on.

Various market trends, such as cloud technology, rising artificial intelligence technology, accelerating adoption of the Internet of Things (IoT), growing social media influence, and the introduction of innovative small household appliances, will all contribute to the growth of the US household appliances market. For instance, In October 2020, Spring USA launched new LoPRO induction range series of lightweight and designed for durability. This product features high-grade polymer housing and tempered glass on top.

Browse through Grand View Research's Electronic & Electrical Industry Research Reports.

- The global appliances market size was valued at USD 969.4 billion in 2016 and is projected to register a CAGR of 7.2% in the coming years.

- The global smart home market size was valued at USD 79.16 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 27.07% from 2023 to 2030.

U.S. Household Appliances Market Segmentation

Grand View Research has segmented the U.S. household appliances market report on the basis of product, distribution channel, and region

U.S. Household Appliances Product Outlook (Revenue, USD Million, 2018 - 2030)

- Water Heater

- Dishwasher

- Refrigerator

- Cooktop, Cooking Range, Microwave, and Oven

- Vacuum Cleaner

- Mixer, Grinder, and Food Processor

- Washing Machine

- Air Conditioner

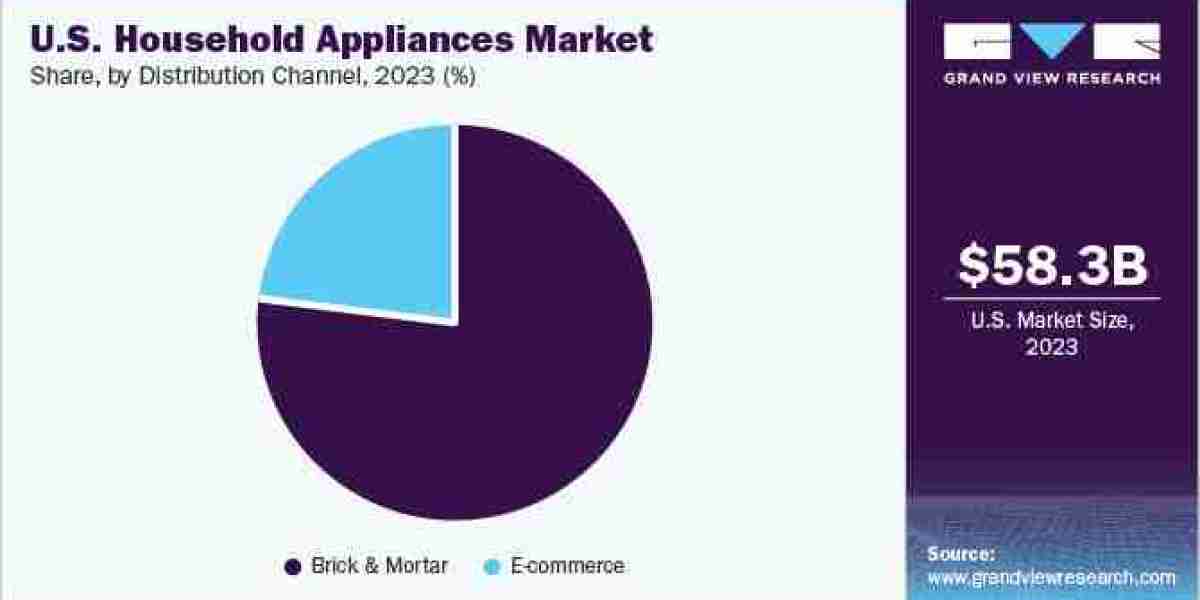

U.S. Household Appliances Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Brick & Mortar

- E-commerce

U.S. Household Appliances Regional Outlook (Revenue, USD Million, 2018 - 2030)

- Northeast

- Southeast

- Southwest

- Midwest

- West

Key Companies profiled:

- Whirlpool Corporation

- Electrolux AB

- Fisher & Paykel Appliances Holdings Ltd.

- Frigidaire

- GE Appliances

- Haier Group

- LG Electronics

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- SMEG S.p.A.

- Miele & Cie. KG

- iRobot Corporation

Key U.S. Household Appliances Company Insights

The market includes both international and domestic participants. Key players focus on strategies such as innovation and new product launches in retail about household appliances in the U.S. to enhance their portfolio offerings in the market. For instance, in September 2022, the most sophisticated robot vacuum and mop, the Roomba ComboTM j7+, was launched by Robot Corporation, a pioneer in consumer robots, coupled with smart iRobot OS 5.0 upgrades. This robot vacuum is intended for active families with a variety of carpets, rugs, and hard floors as well as those looking for a robot vacuum that can also mop.

Recent Developments

- In March 2022, Samsung Electronics launched a new model of its Bespoke French Door refrigerator at CES 2022. The new line combines unique and customizable designs with Samsung's latest storage and cooling innovations to provide consumers with the refrigerator they've always wanted with the convenience they truly require. Families can choose from 12 stylish glass and steel finishes to complement their kitchen, while the SpaceMax technology ensures they can comfortably store all of their groceries for all types of cooking.

- In February 2022, Spectrum Brand Holdings Inc., a leading global branded consumer products and home essentials company, announced that it had signed a definitive agreement to acquire the home appliances and cookware categories of Tristar Products, Inc. (the “Tristar Business”) for USD 325 million

- In February 2022, LG Electronics launched a new device in the dishwashing category, with features like QuadWash Pro and Dynamic Heat Dry technologies, designed with a multitude of engineering enhancements to offer consumers smarter cleaning innovation and the ultimate convenience.

Order a free sample PDF of the U.S. Household Appliances Market Intelligence Study, published by Grand View Research.