Polyethylene Terephthalate (PET) Procurement Intelligence

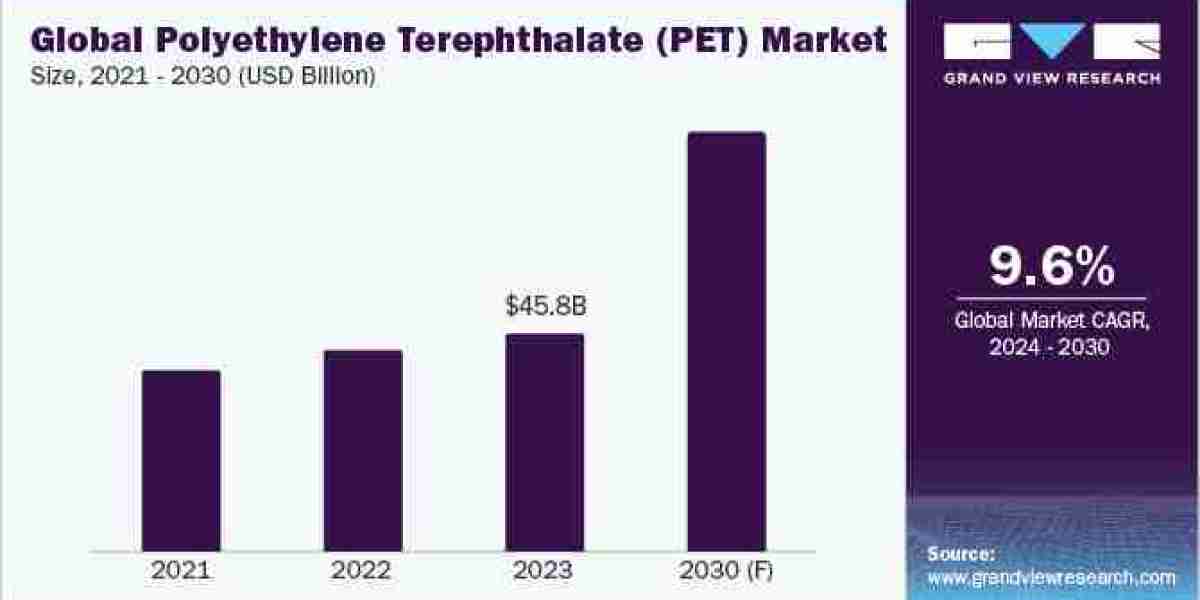

Procurement of polyethylene terephthalate (PET) has gained traction across applications, including packaging and textiles, among others. The global market size was valued at USD 45.8 billion in 2023. Future expansion is anticipated to be driven by the growing procurement from the automobile sector.PET, is a thermoplastic polymer that is widely used in automobiles due to its adaptability and resilience to different weather conditions.It contributes significantly to the performance, safety, and visual appeal of modern automobiles' outer and interior components.

The increased demand for automobiles is anticipated to spur the product demand. In addition, The e-commerce and healthcare sectors' growing inclination towards recyclable packaging, along with the ongoing progress in lightweight technologies, will propel the polyethylene terephthalate market share throughout the analysis period.

3D printing and material simulation technologies are fuelling the industry. Limitations of traditional polymer-based product manufacturing techniques include time-consuming tooling requirements, high production costs, and complex design requirements. However, advancements in 3D printing are making PET manufacturing better by making it easier to create detailed shapes and complicated geometries that were previously difficult or impossible to produce. In addition, the development or creation of novel polymers is extremely challenging due to the complicated material behavior, unpredictable mechanical qualities, and difficulties in forecasting long-term durability.Researchers can identify important characteristics and material qualities by simulating the behavior of polymers under various situations using computer modeling and simulation approaches.

Order your copy of the Polyethylene Terephthalate (PET) procurement intelligence report 2024-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Asia Pacific region dominates the global landscape, followed by North America and Europe. Asia-Pacific and North America are the primary consumers of the products, holding a combined volume share of roughly 65.9% to 67.9%. Due to stricter laws, manufacturers in the North America and Europe regions have been compelled to relocate their production facilities to developing economies in Asia Pacific, which offers skilled labor and land at significantly reduced prices. The PET sector in the U.S. is relatively mature yet still expanding because of the strong demand from numerous end-use industries, such as packaging, electronics, construction, automobiles, and others. In addition, the confidence of consumers and their spending have significantly increased as a result of the economy's recovery from the recession in the nation.

After the outbreak of the COVID-19 pandemic, many customers shifted to internet purchasing due to government measures to practice social distancing at that time. As a result, the e-commerce sector experienced a sharp increase in online purchasing. During that time, there was an increase in the demand for packaging materials from the pharmaceuticals and consumer goods sectors due to the surge in online purchases of necessities, including groceries, medications, packaged meals, and beverages. Furthermore, the adoption of PET packaging solutions was spurred by significant expansion in the healthcare and e-commerce industries. Under the current circumstances, the packaging industry is operating at maximum capacity and has recovered to pre-COVID-19 levels. This has had a favorable impact on market expansion.

Polyethylene Terephthalate (PET) Sourcing Intelligence Highlights

- The Global Polyethylene Terephthalate (PET) market is highly competitive, exhibiting a fragmented landscape with the presence of a large number of regional and global players operating in the industry.

- Buyers possess high negotiating capability due to the intense competition among the suppliers, enabling them with flexibility to switch to a better alternative.

- China is the preferred lowest-cost country for sourcing Polyethylene Terephthalate (PET). Manufacturers are able to sell a substantial amount of their goods within the country in the wake of its vast and quickly expanding domestic market.

- Raw materials, labor, machinery and equipment, transportation, rent and utilities, and others are the key cost components of polyethylene terephthalate. Other costs include maintenance and repair, quality assurance and testing, insurance, tax, interest on loans, and administrative fees.

List of Key Suppliers

- Alfa Chemistry

- Alpek S.A.B. de C.V.

- China Petrochemical Corporation (Sinopec)

- China Resources (Holdings) Co., Ltd.

- DuPont de Nemours Inc.

- Far Eastern New Century Corporation (FENC)

- Indorama Ventures Public Company Limited

- Jiangsu Sanfangxiang Group Co., Ltd.

- LOTTE Chemical Corporation

- Reliance Industries Ltd. (RIL)

- Saudi Basic Industries Corporation (SABIC)

- SK Inc.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Office Furniture Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Natural Gas Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Polyethylene Terephthalate (PET) Procurement Intelligence Report Scope

- Polyethylene Terephthalate (PET) Growth Rate: CAGR of 9.63% from 2024 to 2030

- Pricing Growth Outlook: 4% - 9% increase (Annually)

- Pricing Models: Cost-plus pricing, Fixed pricing, Competition-based pricing

- Supplier Selection Scope: Cost and pricing, Past engagements, Productivity, Geographical presence

- Supplier Selection Criteria: Industries served, geographical service provision, years in service, employee strength, revenue generated, certifications, key clientele,types of PET, technologies deployed in production, customization options, regulatory compliance, customer support, lead time, and others

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions