Pet Insurance Industry Overview

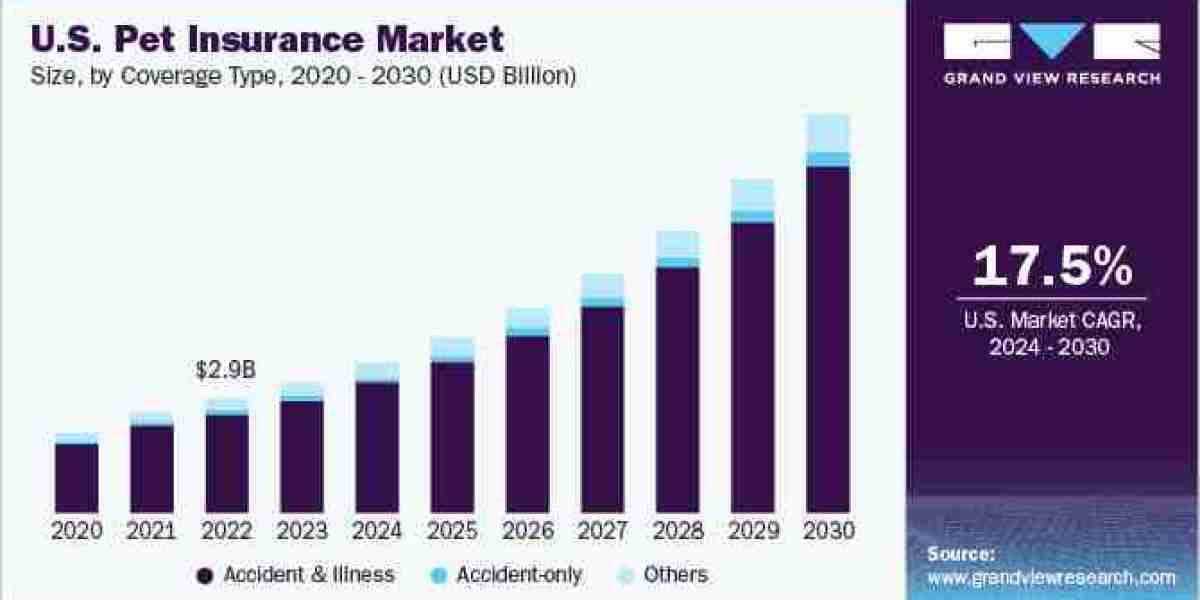

The global pet insurance market size was estimated at USD 11.87 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 14.15% from 2024 to 2030.

The growing pet population, adoption of pet insurance in underpenetrated markets, increasing veterinary care costs, initiatives by key companies, and humanization of pets are some of the key factors driving the market growth. The latest findings from the 2023 State of the Industry (SOI) report by NAPHIA indicate that there are currently 5.36 million insured pets across North America. This represents a 21.7% increase compared to 2021 when the total number of insured pets in the area was 4.4 million. The rising incidence of diseases in cats & dogs and the increasing trend of pet adoption are expected to propel market growth.

Gather more insights about the market drivers, restrains and growth of the Pet Insurance Market

In addition, there is a growing need for pet insurance to help mitigate expenses associated with serious medical conditions like accidental injuries and cancer, thereby fueling market expansion. The surge in demand for veterinary healthcare facilities is also expected to drive the adoption of pet insurance, as these services often involve significant capital investment, specialized personnel, and specialized diagnostic equipment, leading to higher treatment costs for pet owners. In addition, increasing disposable income of pet owners, especially in developing economies, has made pet insurance more affordable and accessible, driving market growth.

The COVID-19 pandemic posed significant challenges for various stakeholders in the companion animal industry, including pet owners, veterinarians, veterinary hospitals, and animal health companies. However, the industry quickly responded by implementing supportive measures to ensure continued access to veterinary care and related services. The pandemic-induced challenges also prompted pet parents to become more aware of the importance of mitigating financial risks by acquiring pet insurance policies. A survey conducted by Petplan, a leading player in the UK market, revealed a rise in pet ownership during 2020, with dogs being the most favored pets followed by cats.

Approximately 47% of respondents reported acquiring pets for the first time, and overall, around 26% of pet owners in the UK welcomed a new pet amid the COVID-19 pandemic. Three key reasons for getting a pet were identified to be work-from-home conditions, desire for companionship, and more time spent at home due to lockdown & movement restrictions. One-fifth of the respondents stated that they were more likely to buy an insurance policy for their pets. Overall, the pandemic increased the demand for risk protection among pet parents. Companies, such as Animal Friends Insurance, began offering coverage for remote consultation by partnering with Joii Pet Care. This, combined with growing pet humanization and expenditure, will propel market growth.

Browse through Grand View Research's Animal Health Industry Research Reports.

- The global Animal Health market size was valued at USD 62.40 billion in 2023and is projected to grow at a compound annual growth rate (CAGR) of 9.0% from 2024 to 2030.

- The U.S. companion animal health market size was estimated at USD 12.30 billion in 2023 and is expected to expand at a CAGR of 7.93% from 2024 to 2030.

Pet Insurance Market Segmentation

Grand View Research has segmented the global pet insurance market on the basis of coverage type, animal type, sales channel, and region:

Pet Insurance Coverage Type Outlook (Revenue, USD Million, 2018 - 2030)

- Accident & Illness

- Accident only

- Others

Pet Insurance Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

- Dogs

- Cats

- Others

Pet Insurance Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Agency

- Broker

- Direct

- Bancassurance

- Others

Pet Insurance Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- S.

- Canada

- Europe

- Germany

- K.

- France

- Italy

- Spain

- Netherlands

- Sweden

- Norway

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- Israel

Key Companies profiled:

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Animal Friends Insurance Services Limited

- Figo Pet Insurance, LLC

- Direct Line

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- ipet Insurance Co., Ltd.

- MetLife Services and Solutions, LLC

- Pumpkin Insurance Services Inc.

Recent Developments

- In January 2024, Five Sigma, a leader in cloud-based claims management solutions, formed a strategic alliance with Odie Pet Insurance, a company dedicated to making pet insurance more accessible and affordable. This partnership aims to revolutionize pet insurance claims processes and improve industry operations

- In November 2023, Fetchformed a partnership with Best Friends Animal Society, a national organization committed to ending the euthanasia of dogs and cats in American shelters by 2025. As part of this collaboration, Fetch will make substantial donations to support Best Friends' efforts to rehome shelter pets and achieve their goal of making the country a no-kill nation

Order a free sample PDF of the Pet Insurance Market Intelligence Study, published by Grand View Research.