U.S. Windows Industry Overview

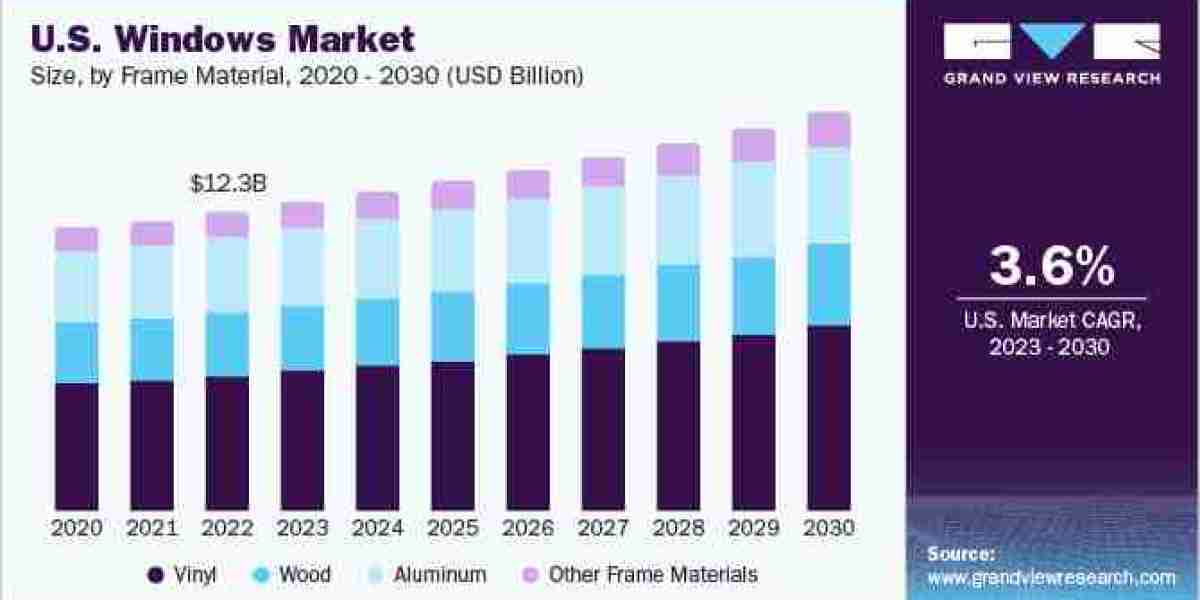

The U.S. windows market size was valued at USD 12.32 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.6% from 2023 to 2030.

This growth can be attributed to rising product demand in the construction and refurbishment of buildings. Moreover, rapid urbanization and industrialization are expected to further lead to the growth of the U.S. windows industry. The significant growth of the fenestration industry can be attributed to the increased construction activities in the market. The growth of commercial spaces, including hospitals, restaurants, and others across the U.S., is projected to drive the construction industry, thereby propelling the demand for windows over the forecast period.

Gather more insights about the market drivers, restrains and growth of the U.S. Windows Market

The U.S. is considered a mature market in windows. Strong market position, favorable business environment, and improving commodity prices are projected to fuel market growth in the U.S. The growth of the country’s tourism industry is driving increased investments toward establishing tourist infrastructure such as hotels, resorts, and restaurants. Moreover, factor such as the rising population is expected to further augment the need for residential spaces, thereby providing a significant boost to the construction industry and, consequently, increasing the demand for windows over the coming years.

The manufacturers distribute their products through independent dealers, wholesale distributors, retailers, individual customers, and contractors. For instance, PGT Innovations Inc. distributes its products through national building supply distributors, U.S. home building’s in-home sales/custom order division, improvement supply retailers, direct-consumer channels, and through independently owned dealers and distributors. This vast and robust distribution network is a prominent factor offering a competitive edge and boosting product sales of the company.

Browse through Grand View Research's Green Building Materials Industry Research Reports.

- The global energy efficient buildings market size was estimated at USD 28.40 billion in 2023 and is projected to grow at a CAGR of 11.1% from 2024 to 2030.

- The global pervious concrete pavers market size was estimated at USD 9.13 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030.

U.S. Windows Market Segmentation

Grand View Research has segmented the U.S. windows market based on frame material, type, end-use, and state:

U.S. Windows Frame Material Outlook (Revenue, USD Million, 2018 - 2030)

- Vinyl

- Wood

- Aluminum

- Other Frame Materials

U.S. Windows Type Outlook (Revenue, USD Million, 2018 - 2030)

- Sliding Windows

- Double/Single-hung Windows

- Casement Windows

- Awning Windows

- Tilt & Turn Windows

- Other Windows

U.S. Windows End-use Outlook (Revenue, USD Million, 2018 - 2030)

- New Construction

- Refurbishment

U.S. Windows State Outlook (Revenue, USD Million, 2018 - 2030)

- U.S.

- Texas

- New York

- California

- Florida

- Pennsylvania

- Ohio

- Massachusetts

- Georgia

- Illinois

- Arizona

- Virginia

- North Carolina

- Michigan

- Tennessee

- Wisconsin

- Washington

- Colorado

- Indiana

- New Jersey

- Louisiana

Key Companies profiled:

- Jeld-Wen Inc.

- PGT Innovation, Inc.

- Cornerstone Building Brands

- Andersen Corporation

- The Pella Corporation

- Starline Windows

- MI Windows and Doors

- Marvin

- VELUX Group

- Harvey Building Products

- Apogee Enterprises, Inc.

- Associated Materials Incorporated

- Profine International Group

Order a free sample PDF of the U.S. Windows Market Intelligence Study, published by Grand View Research.