Bottled Water Industry Overview

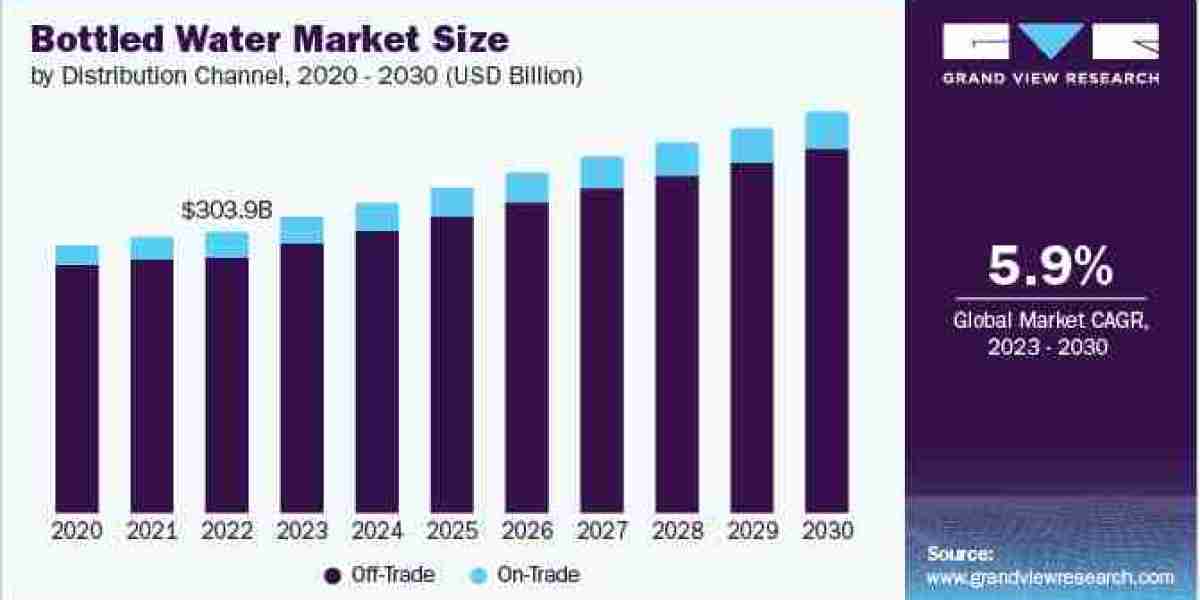

The global bottled water market size was estimated at USD 303.95 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030.

Increasing concerns regarding various health problems such as gastrointestinal diseases caused by the consumption of contaminated water are leading to increased demand for clean and hygienic packaged options. Drinking water scarcity in several regions further necessitates demand for safe drinking water, leading to increased product sales, and augmenting the market growth.

Gather more insights about the market drivers, restrains and growth of the Bottled Water Market

The increasing preference for nutrient-fortified water is trending due to the rising importance of health and wellness among consumers. The demand has increased among travelers, working professionals, and in-house consumers. Over the past few years, products with labels such as alkaline, electrolyte-rich, fortified, caffeinated water, fortified with additional hydrogen or oxygen have been gaining popularity.

Consumers are increasingly prioritizing their health and wellness, which is boosting the demand for purified and ultra-purified bottled options. Consumers chose to opt for these bottles on the go, as it is a healthier option for high-calorie, carbonated, and sugary drinks such as sports drinks and juices. According to data from the Beverage Marketing Corporation, the volume growth of bottled water slowed down in 2022 compared to the previous year, but producers' revenues increased by nearly 12% due to higher prices.

The per capita consumption of bottled water reached a new high of 46.5 gallons, while carbonated soft drinks remained at 36 gallons. Single-serving sizes were the most popular type of bottled water, accounting for the majority of the category's volume. Beverage Marketing Corporation expects bottled water to continue to grow and surpass carbonated soft drinks.

Browse through Grand View Research's Consumer F&B Industry Research Reports.

- The global sports drink market size was valued at USD 22.37 billion in 2018, expanding at a healthy CAGR over the forecast period.

- The global carbonated soft drink market size was valued at USD 221.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2021 to 2028.

Bottled Water Market Segmentation

Grand View Research has segmented the global bottled water market based on product, packaging, distribution channel, and region:

Bottled Water Product Outlook (Revenue, USD Billion, 2017 - 2030)

- Still Water

- Sparkling Water

- Functional Water

- Others

Bottled Water Packaging Outlook (Revenue, USD Billion, 2017 - 2030)

- PET

- Cans

- Others

Bottled Water Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

- Off-trade

- Supermarkets & Hypermarkets

- Convenience Stores

- Grocery Stores

- Others

- On-trade

Bottled Water Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Singapore

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- A.E.

Key Companies profiled:

- Nestlé

- PepsiCo

- The Coca-Cola Company

- DANONE

- Primo Water Corporation

- FIJI Water Company LLC

- Gerolsteiner Brunnen GmbH & Co. KG

- VOSS WATER

- Nongfu Spring

- National Beverage Corp.

- Keurig Dr Pepper Inc.

Key Bottled Water Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, and global expansions. Some of the largest food and beverage companies including Nestlé, PepsiCo, and The Coca-Cola Company have entered into the market. Along with that, to improve their efficiency and by using the international distribution channel, the companies have been ruling the industry.

- For instance, in September 2022, Waterloo Sparkling Water, a brand known for its flavored sparkling water beverages, expanded its product lineup with the launch of two new flavors called "Sweater Weather." The new flavors, "Pumpkin Spice" and "Caramel Apple," aim to capture the essence of fall and the popular seasonal flavors associated with it.

Order a free sample PDF of the Bottled Water Market Intelligence Study, published by Grand View Research.