Human Milk Oligosaccharides Industry Overview

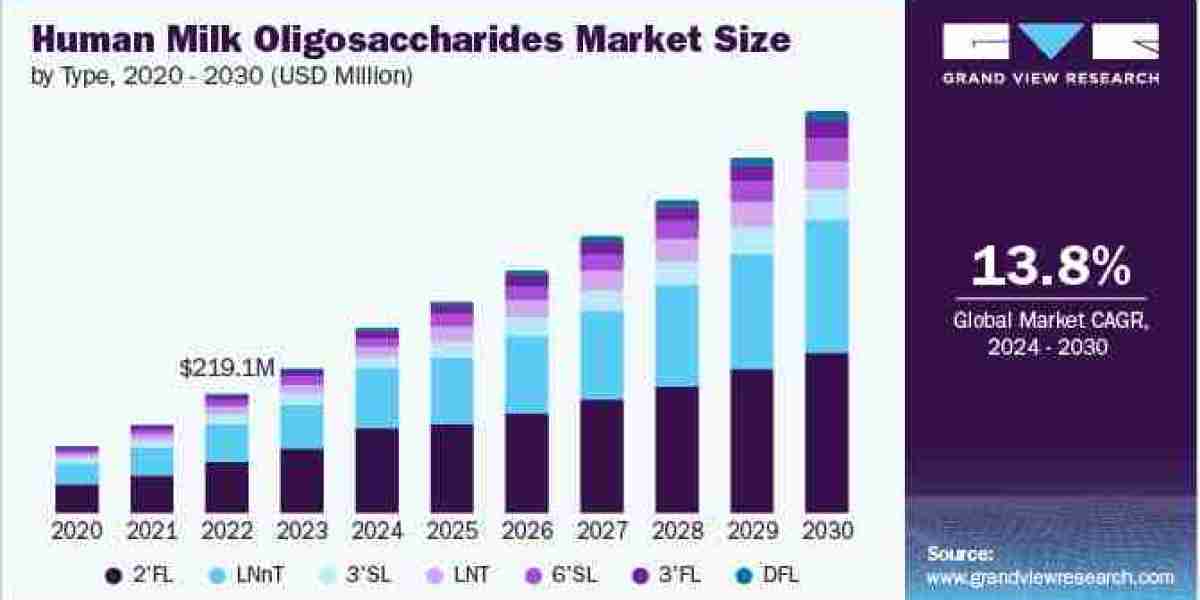

The global human milk oligosaccharides market size was estimated at USD 264.20 million in 2023 and is expected to grow at a CAGR of 13.8% from 2024 to 2030.

The rising interest in infant nutrition, increasing R&D supporting the health benefits of human milk oligosaccharides (HMOs), technological advancements in HMO production, and favorable regulatory frameworks are propelling the market growth. Consumers are also becoming more health-conscious and seeking products with functional benefits, such as gut health and immune system support. HMOs are recognized for their prebiotic properties and potential to promote a healthy gut microbiome, driving their demand in functional foods and supplements.

Gather more insights about the market drivers, restrains and growth of the Human Milk Oligosaccharides Market

There has been a significant rise in awareness of the importance of proper infant nutrition. Parents are becoming more conscious of nutrition's role in their child’s development, leading to an increased demand for HMO-based products. Manufacturers are developing formulas with specific HMO blends to mimic breast milk's immune-boosting properties, enhance gut health, and potentially aid brain development. For instance, in November 2023, Nestlé introduced its inaugural infant formula incorporating human milk oligosaccharides (HMOs) into the Chinese market, marketed under the Wyeth Illuma brand. The product includes two primary types of HMOs found in breast milk-2'Fucosyllactose (2'FL) and Lacto-N-(neo)tetraose (LNnT)-alongside beneficial lipids and proteins.

The ability to efficiently synthesize HMOs has spurred extensive industry R&D. Biotechnology companies and research institutions are now able to explore a broader range of HMOs and their potential health benefits. For instance, ongoing research is investigating the role of various HMOs in modulating the gut microbiome, enhancing immune function, and preventing infections. This expanded R&D effort is not only increasing the understanding of HMOs but also leading to the development of new and innovative HMO-based products. In January 2024, Kyowa Hakko Bio partnered with Singapore's Agency for Science, Technology, and Research (A*STAR) to advance research on Human Milk Oligosaccharides (HMOs). The collaboration aims to deepen understanding of HMOs and their potential applications in promoting health across the lifespan. Key objectives include exploring the benefits of HMOs in supporting immune regulation and promoting a healthy gut microbiome.

Technological advancements and innovation in the biotechnology sector further catalyze the HMO market. The development of cost-effective methods for synthesizing HMOs on a large scale has made it feasible for manufacturers to incorporate these ingredients into a wider array of products. This has opened up new opportunities for food and beverage companies to enhance their product offerings with the health benefits of HMOs, thereby increasing market penetration and growth.

Browse through Grand View Research's Nutraceuticals & Functional Foods Industry Research Reports.

- The global digestive health supplements market sizewas valued at USD 13.30 billion in 2023 and is projected to grow at a CAGR of 9.6% from 2024 to 2030.

- The global fiber supplements market size was valued at USD 13.5 billion in 2023 and is expected to grow at a CAGR of 5.9% from 2024 to 2030.

Human Milk Oligosaccharides Market Segmentation

Grand View Research has segmented the global human milk oligosaccharides market based on type, and application:

Human Milk Oligosaccharides Type Outlook (Revenue, USD Million, 2018 - 2030)

- 2’FL

- 3’FL

- 3’SL

- 6’SL

- LNT

- LNnT

- DFL

Human Milk Oligosaccharides Application Outlook (Revenue, USD Million, 2018 - 2030)

- Food & Beverages

- Dietary Supplements

- Infant Formula

- Pharmaceuticals

Human Milk Oligosaccharides Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Taiwan

- South Korea

- Vietnam

- Indonesia

- Philippines

- Malaysia

- Singapore

- Central & South America

- Brazil

- Middle East & Africa

Key Companies profiled:

- Glycom A/S

- Hansen Holding A/S

- Kyowa Hakko Europe GmbH

- FrieslandCampina Ingredients

- BASF SE

- Dextra Laboratories Limited

- Inboise N.V.

- Biosynth Limited

- ELICITYL S.A.

- ZuChem Inc.

- RAJVI ENTERPRISE

Recent Developments

- In March 2024, Chr. Hansen passed the biosafety review by China's Ministry of Agriculture and Rural Affairs for all five single HMOs of its MyOli blend. This positioned the company well for infant formula innovation in China, offering a comprehensive mix of HMOs known to support immune system development and gut microbiome health, including the particularly noteworthy 3-FL, which aligns with empirical studies of Chinese mothers' breastmilk

- In January 2024, FrieslandCampina Ingredients received approval from Thai regulators for using its 2’FL in infant and follow-up formula. This made the company Thailand's exclusive supplier of HMO components. It created opportunities for the company to make new formulas that include HMOs

- In January 2024, Chr. Hansen A/S merged with Denmark-based Novozymes A/S to form Novonesis. This new company aimed to be a leader in sustainable solutions with a focus on health, food, and reducing environmental impact. The company has ESG goals of carbon neutrality by 2050

Order a free sample PDF of the Human Milk Oligosaccharides Market Intelligence Study, published by Grand View Research.