Sportswear Industry Overview

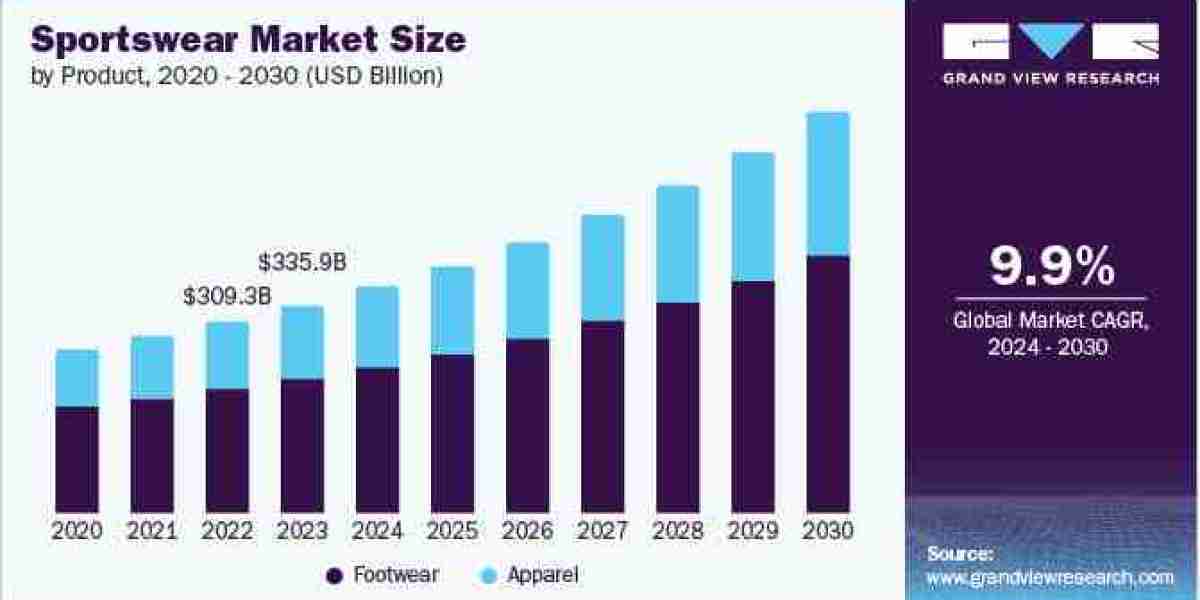

The global sportswear market size was valued at USD 335.92 billion in 2023 and is expected to grow at a CAGR of 9.9% from 2024 to 2030.

The global market is driven by factors such as rising health consciousness, increasing participation in sports and fitness activities, and the growing trend of sports clothes, where athletic clothing is worn in casual settings. Advances in fabric technology, such as moisture-wicking, odor control, and temperature regulation, enhance the functionality and appeal of sportswear. Additionally, the influence of social media and celebrity endorsements has amplified brand visibility and consumer interest. The expansion of e-commerce platforms has made sportswear more accessible, while the emphasis on sustainability and eco-friendly materials resonates with environmentally conscious consumers.

Gather more insights about the market drivers, restrains and growth of the Sportswear Market

The increasing health consciousness among consumers is one of the primary drivers of the global sportswear market. The growing awareness of the importance of maintaining a healthy lifestyle has led to a surge in participation in various physical activities, including running, yoga, gym workouts, and team sports. According to a report by the World Health Organization, the number of people engaging in regular physical activity has risen significantly over the past decade, contributing to the heightened demand for sportswear. This shift towards a healthier lifestyle is not just limited to younger demographics but also includes older adults who are adopting fitness regimes to improve their overall well-being.

The athleisure trend, where athletic apparel is worn in non-athletic settings, has significantly boosted the sportswear market. Athleisure blurs the lines between gym wear and casual wear, making it acceptable to wear sports clothing in everyday activities. This trend is particularly popular among millennials and Gen Z, who prioritize comfort and style. Brands like Nike, Adidas, and Lululemon have capitalized on this trend by launching stylish and versatile sportswear collections that can be worn both in and out of the gym.

Innovations in fabric technology and design have played a crucial role in the growth of the sportswear market. Manufacturers are constantly developing new materials that enhance performance, such as moisture-wicking fabrics, anti-odor treatments, and temperature-regulating textiles. These advancements improve comfort and functionality, making sportswear more appealing to consumers. For instance, Under Armour's HeatGear and ColdGear lines are designed to keep athletes comfortable in extreme temperatures. Similarly, Nike's Dri-FIT technology helps wick sweat away from the body, keeping athletes dry and comfortable during workouts.

Browse through Grand View Research's Clothing, Footwear & Accessories Industry Research Reports.

- The global smart shoes market sizewas valued at USD 422.4 million in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030.

- The global blanket market size was valued at USD 15.14 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030.

Sportswear Market Segmentation

Grand View Research has segmented the global sportswear market on the basis of product, distribution channel, end-user, and region:

Sportswear Product Outlook (Revenue, USD Million, 2018 - 2030)

- Footwear

- Apparel

Sportswear End-user Outlook (Revenue, USD Million, 2018 - 2030)

- Men

- Women

- Children

Sportswear Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Online

- Offline

- Sporting Goods Retailers

- Supermarkets & Hypermarkets

- Exclusive Brand Outlets

- Others

Sportswear Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- K.

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- South Korea

- Central & South America

- Brazil

- Middle East & Africa

- South Africa

Key Companies profiled:

- Nike, Inc.

- Adidas AG

- LI-NING Company Limited

- Umbro Ltd.

- Puma SE, Inc.

- Fila, Inc.

- Lululemon Athletica Incorporation

- Under Armour

- Columbia Sportswear Company

- Anta Sports Products Limited, Inc.

Recent Developments

- In June 2024, Reebok introduced its first ever pickleball shoe, the Nano Court. Designed for sports such as pickleball, padel, and tennis, the shoe prioritizes grip, stability, and durability. It features Flexweave Pro uppers, incorporating Reebok’s most resilient Flexweave knit yet, with zoned stability yarns for targeted support. Additionally, the shoe includes ToeTection Guard at the toe box for enhanced durability, along with a 360 Comfort Booty anatomical upper construction for a secure fit.

- In June 2024, Stack Athletics, a leading brand in pickleball-specific performance apparel, unveiled its Summer 2024 performance collection tailored for pickleball enthusiasts. The collection introduces new colors, patterns, and pieces featuring innovative technology, such as the Men's Flowstate Zip Tee, Women's Rush Skirt, and Men's Tourney Short. These garments are designed to regulate body temperature and enhance agility with lightweight fabrics, keeping players swift on the court.

Order a free sample PDF of the Sportswear Market Intelligence Study, published by Grand View Research.