Legal Services Procurement Intelligence

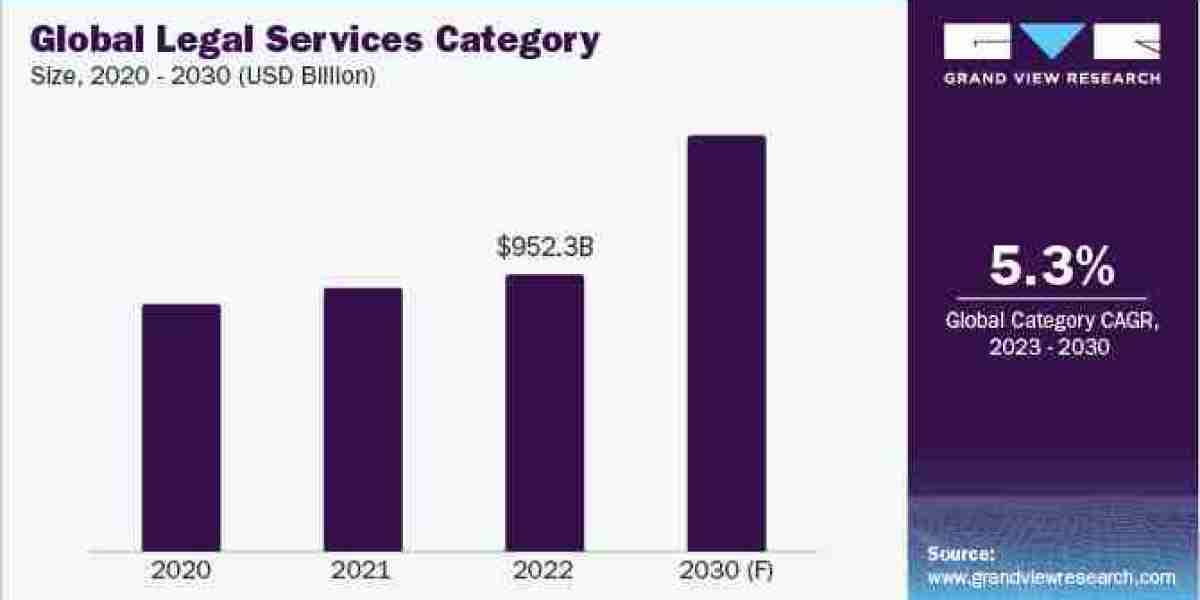

The legal services category is expected to grow at a CAGR of 5.3% from 2023 to 2030. The legal industry has undergone a transformationtransformed due to the rise of Artificial Intelligence (AI). AI-powered software has become crucial in enabling law firms and lawyers to streamline their processes, saving valuable time. Automation tools enhance the efficiency of document creation and review, while collaborative platforms further simplify documentation procedures. These technological innovations help attorneys reduce costs and enhance convenience.

A growing number of law firms are using chatbots to improve their operational efficiency, ultimately saving them and their client’s time and money. These chatbots are capable of aiding legal companies in tasks such as digitizing data, searching for lawyer-specific documents, and handling various other activities. Additionally, they can assist in tasks like following up with unresponsive clients and gathering crucial information through automated conversations.

With the onset of AI, the current hierarchical structure of legal firms is expected to flatten due to the imminent demise of billable hours. Additionally, tTraditional firms will are expected to face increased competition from AI-driven tech companies acting as Alternative Legal Service Providers (ALSPs). Law firms might transform into tech-oriented entities, creating their own AI tools to provide AIaaS (Artificial Intelligence as a Service (AIaaS). This evolution in the industry, driven by AI, offers substantial opportunities and challenges in the industry. Firms that harness these advanced tools stand to enhance efficiency and accuracy, while significantly broadening their range of services.

Order your copy of the Legal Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

With the ongoing advancement of in technology, the prevalence of cyber threats has increased, giving rise to a new trend in the industry. Lawyers now face fresh challenges related to cybersecurity, emphasizing the need for expertise in this area. As technology and cyber threats continue to grow in complexity, lawyers play a vital role in tackling cybersecurity concerns. Their understanding of legal frameworks, risk management, compliance, litigation, and due diligence is essential in addressing these evolving challenges.

In recent years, in-house law departments have expanded both in scale and in influence, managing a larger volume of intricate tasks that were previously outsourced to law firms. Nowadays, many in-house departments adopt a business-oriented approach to legal services, involving professionals from various fields such as business, IT, and procurement to assess external service providers.

Law firms must establish their identity as service providers capable of utilizing AI tools effectively while also delivering unique human skills that AI cannot mimic. These human abilities will remain essential to the value proposition of human lawyers in the future.

Legal Services Sourcing Intelligence Highlights

- The legal service category has a high barrier to entry due to factors such as stringent regulations, the need for extensive expertise, and license requirements.

- The category is fragmented due to the presence of numerous players and the rise of ALSPs providing services at lower costs. Law firms try to differentiate by case resolution time, win rate, and client satisfaction.

- Consultant salaries and licenses, office rent/lease, office equipment, insurance, utilities, and othersare some of the costs incurred in providing services.

List of Key Suppliers

- FindLaw

- Avvo

- LegalZoom

- Baker McKenzie

- Baker Hostetler

- Goodwin Procter

- LegalShield

- Rally

- Deloitte

- PwC

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Legal Services Procurement Intelligence Report Scope

- Legal Services Category Growth Rate : CAGR of 5.3% from 2023 to 2030

- Pricing Growth Outlook : 2% - 3% (Annually)

- Pricing Models : Value-based pricing, service-based pricing, competition-based pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Diversified types of cases handled, win rate, experience in the field, case resolution time, transaction support, global reach, regulatory compliance, technical specifications, operational capabilities, quality measures, certifications, data privacy regulations, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions