Industrial Gases Category - Procurement Intelligence

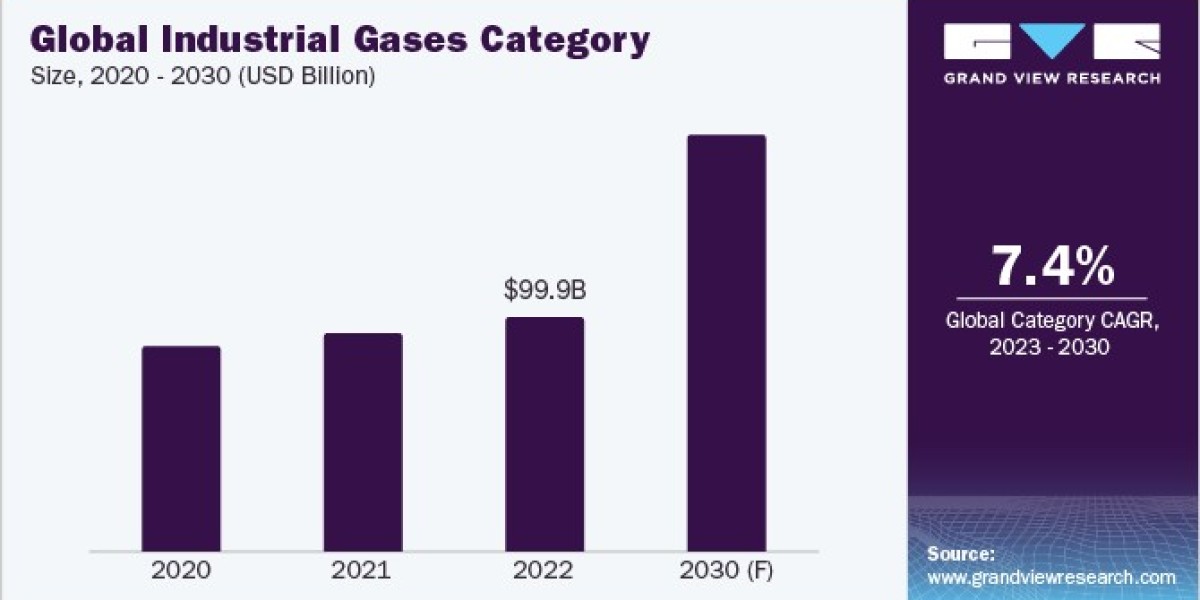

The industrial gases category is anticipated to witness growth at a CAGR of 7.42% from 2023 to 2030. In 2022, Asia Pacific accounted for 37% of the market share followed by North America and Europe. With a majority share in North America, the United States is anticipated to continue its dominance throughout the forecast duration. Due to the existence of numerous significant industrial gas suppliers, including Linde, Air Liquide, Messer, and Air Products & Chemicals, the United States has emerged as one of the leading users of industrial gases. The U.S. market for industrial gases is anticipated to rise as a result of the country's expanding healthcare sector and the increased R&D resulting from the recent COVID-19 pandemic.

In terms of the form of distribution, the cylinder segment held a major revenue share in 2022. It is the distribution method that customers choose the most. Independent gas distributors engage in this form of distribution by acquiring gas from producers and compressing it within their packaging facilities. Another common supply of gases is in liquid form, available at ambient temperature. The gases are kept at low pressure in thin-walled steel or composite aluminum cylinders. The bulk distribution segment (Liquid Gas Transport) held the second-largest share. Bulk distribution involves the gas being transported either by pipeline (across large distances) in its natural or liquefied state or by road (using specialized trailers). This delivery method is best used when there is a greater demand for gases than packaged gas distribution but not as much as onsite distribution.

Order your copy of the Industrial Gases category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Technological developments in the industry are continuously fueling the growth of the global category due to the presence of technologies such as Internet of things (IoT), Artificial Intelligence (AI), big data & analytics, and robotics & automation. Industries such as oil & gas are increasingly deploying robotics & automation to ensure enhanced safety of workers, faster operations, and reduced risk. The safety of oil and gas operators is often compromised due to the challenging and complex conditions. Robotic solutions are very helpful in refineries and oil rigs as they can support inspections, surveys, and industrial automation. Furthermore, large volumes of unstructured data are produced by normal operations in the oil & gas sector. The data analysts working in the sector can use big data platforms to extract insights from production and performance data. This can also be helpful to engineers who are attempting to optimize production and ensure reservoir security.

During the outbreak of COVID-19, most nations across the globe saw a decrease in the demand for industrial gases as a result of the closure of industrial enterprises, which also caused the market for industrial gases to shrink due to the temporary closure of industrial facilities, having a detrimental effect on the category's growth. However, post-COVID recovery has led the industry to regain its demand. The need for hydrogen gas, which is utilized in refineries, has increased as a result of the growth in demand for products from the oil and gas sector. In addition, the need for industrial gases utilized in the aerospace industry has increased as a result of the growth in space-based activities and the privatization of space exploration in major industrialized and developing nations.

Industrial Gases Intelligence Highlights

- The global industrial gases category is consolidated with the presence of a small number of significant firms that control most of the market share and have multiple channels for the production and distribution of their finished products across the world.

- China is the preferred low-cost/best-cost country for sourcing industrial gases due to rising gas supplies, low-cost clean energy, sustainable gas pipeline connection fees, and strong pass-through mechanisms.

- The bargaining power of suppliers is moderate. Manufacturers only work with a select group of long-term suppliers to preserve productivity and low operating costs.

- Feedstock (natural gas), energy, labor, logistics, storage, equipment, depreciation, and taxes & profits are the major cost components of industrial gases.

List of Key Suppliers

- Air Products and Chemicals, Inc.

- BOC Limited

- Coregas Pty Ltd

- Iwatani Corporation

- L’Air Liquide S.A.

- Linde plc

- Matheson Tri-Gas, Inc.

- Messer SE & Co. KGaA

- Strandmøllen A/S

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

- Yingde Gases Group Company Limited

Browse through Grand View Research’s collection of procurement intelligence studies:

- Mining Equipment Industry Procurement Intelligence, Supplier Intelligence, Supplier Ranking, Pricing & Cost Structure Intelligence, Best Practices, Engagement Model, Low & Best Cost Country, Day One Analysis Report, 2020 – 2027

- Cyber Security Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Industrial Gases Procurement Intelligence Report Scope

- Industrial Gases Category Growth Rate : CAGR of 7.42% from 2023 to 2030

- Pricing Growth Outlook : 5% - 10% increase (Annually)

- Pricing Models : Cost-plus pricing, fixed pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Industries served, revenue, employee strength, certifications, production capacity, types of gases (carbon dioxide, nitrogen, hydrogen, oxygen, etc.), and others.

- Report Coverage : Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions