Pursuing an investment career is a path that offers both intellectual challenge and financial reward. As global markets expand and evolve, the demand for skilled professionals in finance and investing continues to rise. Whether one aims to work as a financial analyst, portfolio manager, private equity associate, or hedge fund strategist, the world of investing offers a wide range of dynamic career opportunities.

Understanding an Investment Career

An investment career involves analyzing financial markets, evaluating assets, and making informed decisions to generate returns for individuals, institutions, or funds. Professionals in this field are responsible for assessing risks, conducting market research, and constructing portfolios that align with client or institutional goals.

There are various roles within this career path:

Equity analysts focus on analyzing stocks and public companies.

Fixed-income analysts evaluate bonds and interest rate products.

Buy-side professionals manage assets for institutions like mutual funds or pension funds.

Sell-side analysts offer research and recommendations to clients and traders.

Private equity and venture capital professionals invest in companies directly, focusing on long-term value creation.

Hedge fund managers seek alpha through various investment strategies across asset classes.

Skills Required for Success

Building a successful investment career requires a combination of technical expertise, strategic thinking, and communication skills. Among the most important competencies are:

Financial modeling and valuation

Understanding of economic indicators and market trends

Quantitative and qualitative analysis

Proficiency with tools like Excel, Bloomberg, and Python (in quant roles)

Strong writing and presentation abilities to convey investment theses

In addition to hard skills, professionals must also cultivate adaptability, discipline, and a high tolerance for risk and uncertainty—especially in volatile markets.

Educational Pathways

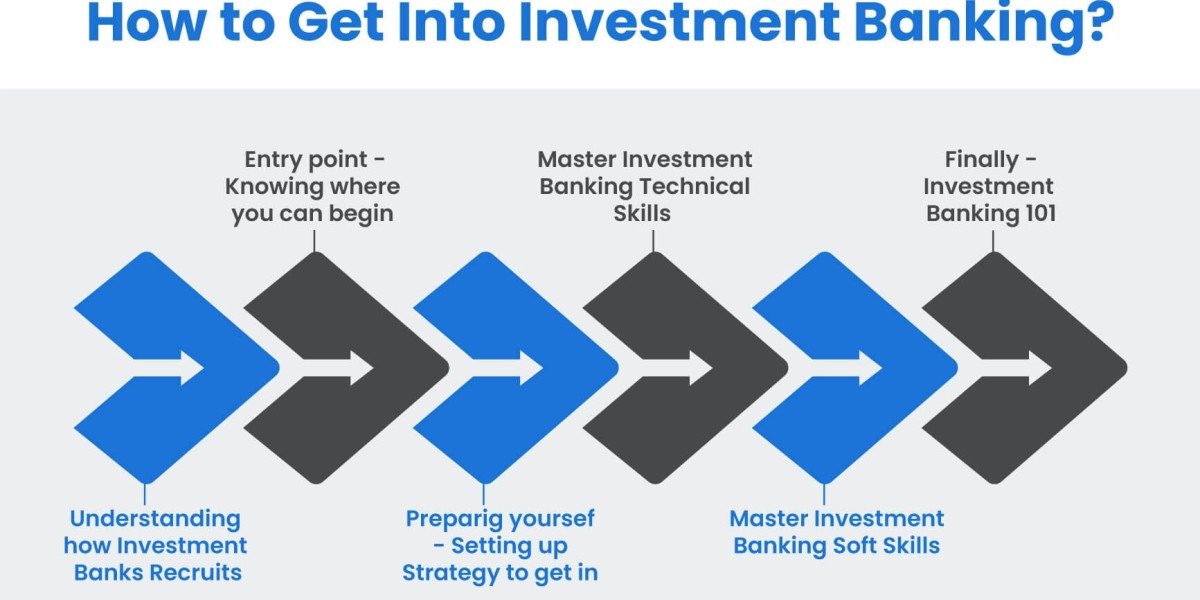

Most professionals begin their journey with a degree in finance, economics, accounting, or a related field. Advanced credentials such as the Chartered Financial Analyst (CFA) designation or a Master of Business Administration (MBA) can significantly boost career prospects. Internships and early exposure to financial institutions are critical for gaining practical experience and building networks in the industry.

Real-World Insight and Strategy

To truly thrive in investing, it's essential to stay updated on market movements and economic developments. Gaining insight from experienced professionals can provide a strategic edge. A great example of this is found through this resource on investment career, where practical knowledge is shared from real-world experience across hedge funds, private equity, and corporate finance. Learning from industry veterans offers valuable lessons that go beyond textbooks.

Career Progression and Long-Term Outlook

Entry-level roles in investment banking or research can lead to more senior positions in asset management, portfolio strategy, or investment advisory. As professionals gain experience and build a track record, they often transition into leadership roles or launch their own investment firms or funds.

The long-term outlook for investment careers is strong, especially as global wealth continues to grow and technology reshapes financial markets. Sustainability, fintech, and alternative investments are emerging areas offering exciting new opportunities.

Conclusion

An investment career is ideal for individuals with a passion for markets, a sharp analytical mind, and a desire to make impactful financial decisions. With the right skills, education, and mentorship, professionals can build rewarding careers in a field that sits at the heart of the global economy.