Running a company, whether little or big, comes with an array of responsibilities, one of the very critical being paycheck management. Ensuring employees are paid precisely and promptly is needed for fostering trust, sustaining output, and adhering to legitimate regulations. In this informative article, we'll discover how firms may streamline their paycheck methods and the advantages of adopting computerized paycheck methods to minimize problems, save your self time, and enhance efficiency.

The Importance of an Accurate Payroll System

Paycheck is more than just an activity of issuing worker salaries. It is a complex procedure that requires calculating wages, withholding fees, managing advantages, and ensuring conformity with federal and state regulations. For almost any organization, the reliability and timeliness of payroll are crucial for several reasons:

- Worker Pleasure: Personnel count on appropriate and appropriate paycheck for their economic security. Late or wrong obligations may result in unhappiness, which can adversely influence worker comfort and productivity.

- Compliance with Rules: Duty regulations and labor rules are constantly changing. Organizations must remain up-to-date with these changes to ensure they conform to regional, state, and federal tax requirements. Failure to comply may result in substantial fines or legitimate action.

- Effective Source Allocation: Paycheck needs substantial time and energy, specially for firms with several employees. An computerized system may reduce the administrative burden, letting HR departments to focus on different strategic activities.

Traditional Payroll vs. Automated Payroll Solutions

Before, several firms handled paycheck personally, which included keeping track of hours worked, calculating wages, withholding deductions, and processing obligations by hand. Nevertheless, that standard approach is time-consuming and susceptible to errors. As firms develop, personally managing paycheck becomes less possible, especially if you have numerous employees or a complex spend structure.

With developments in technology, computerized paycheck methods have become significantly popular. These methods offer a few advantages around standard paycheck methods, including:

- Precision: Computerized paycheck software reduces individual problems connected with manual calculations. These methods instantly compute fees, deductions, and advantages on the basis of the most up-to-date regulations, lowering the chance of mistakes.

- Time Effectiveness: Information paycheck processing will take hours as well as times to perform, specially during tax season. Paycheck automation considerably reduces enough time used on paycheck tasks, liberating up HR staff to focus on more important responsibilities.

- Charge Savings: While there might be an transparent cost to apply an computerized paycheck system, in the future, it can save your self firms money by lowering the requirement for focused paycheck staff and reducing problems that may result in penalties or fines.

- Knowledge Security: Paycheck requires sensitive information, such as worker salaries and tax details. Computerized paycheck methods often include sophisticated safety methods, including encryption, to guard that knowledge from unauthorized access.

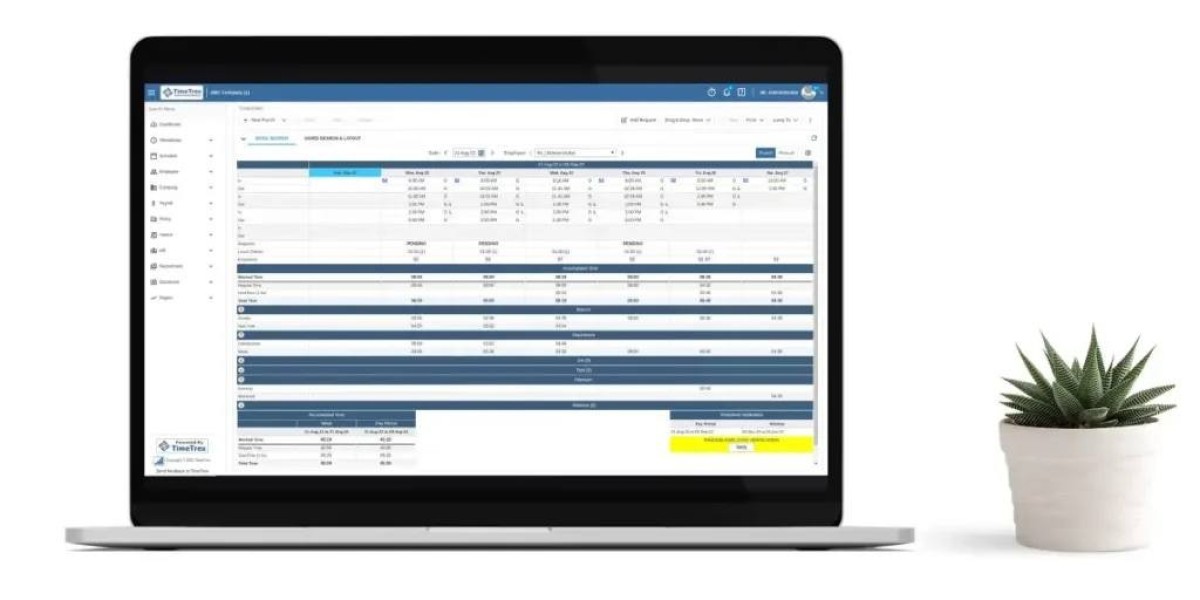

Key Features of an Automated Payroll System

When choosing a paycheck option for your business, there are many important characteristics to look for:

- Worker Self-Service Website: Several contemporary paycheck methods give employees with a self-service site, permitting them to view their spend statements, tax types, and advantages information. This reduces how many inquiries HR departments get and empowers employees to get into their information at any time.

- Duty Compliance: One of the very challenging facets of paycheck is ensuring conformity with tax regulations. Computerized paycheck solutions typically offer integral tax platforms and automatic changes to tax rates, which makes it easier for firms to keep certified with federal and state tax laws.

- Primary Deposit: Primary deposit is just a easy function that enables firms to electronically move worker salaries for their bank accounts. This reduces the requirement for paper checks and guarantees that employees get their wages promptly, without delays.

- Integration with Accounting Software: Several paycheck methods may include with accounting software, streamlining economic processes and ensuring that paycheck expenses are precisely noted in the business's economic statements.

- Personalized Paycheck Choices: Every organization has various paycheck needs, from hourly wages to salaried employees and different benefit structures. Computerized paycheck methods enable modification to meet up the specific demands of your business.

Choosing the Right Payroll System for Your Business

Deciding on the best paycheck system depends on a few factors, including how big is your business, your financial allowance, and your particular paycheck needs. Here certainly are a few considerations to help guide your final decision:

- Organization Size: Small firms with just a couple of employees may manage to use easier paycheck methods, while greater companies with thousands or a large number of employees will need more robust solutions that could manage complicated paycheck processing.

- Scalability: As your business grows, your paycheck needs will evolve. It's important to decide on a paycheck system that could scale with your business and support additional employees, changing spend rates, and growing advantages programs.

- Client Support: Paycheck methods often include support services to help resolve dilemmas and solution questions. Look for a provider with sensitive and educated support, as paycheck problems can have substantial consequences.

- User-Friendliness: While paycheck methods are made to simplify the paycheck method, they should also be simple for your group to use. A user-friendly software and instinctive navigation may reduce teaching time and make certain that the device is successfully utilized.

The Future of Payroll Solutions

As technology remains to evolve, so does the paycheck industry. The ongoing future of paycheck is likely to be driven by synthetic intelligence (AI) and unit understanding, enabling methods to automate even more facets of paycheck processing. For example, AI may potentially estimate paycheck developments centered on traditional knowledge, as well as hole conformity dilemmas before they become problems.

Additionally, the integration of paycheck methods with different organization administration software, such as HR and performance administration resources, can create a more smooth experience for businesses. These developments will keep on to make paycheck processing actually more effective and appropriate, more lowering the administrative burden on businesses.

Conclusion

In today's fast-paced organization world, managing paycheck effectively is needed for sustaining worker satisfaction, ensuring legitimate conformity, and optimizing resources. By adopting an computerized paycheck system, firms may streamline their procedures, lower the chance of problems, and target on which issues most—rising their business.

Purchasing a paycheck option that aligns together with your company's needs and objectives is just a clever decision that will spend dividends in terms of time saved, expenses decreased, and a more effective workforce. Whether you're a small business owner or managing a sizable company, the best paycheck system will make an environment of huge difference in the way you handle your most valuable asset—your employees.