Artificial Intelligence Industry Overview

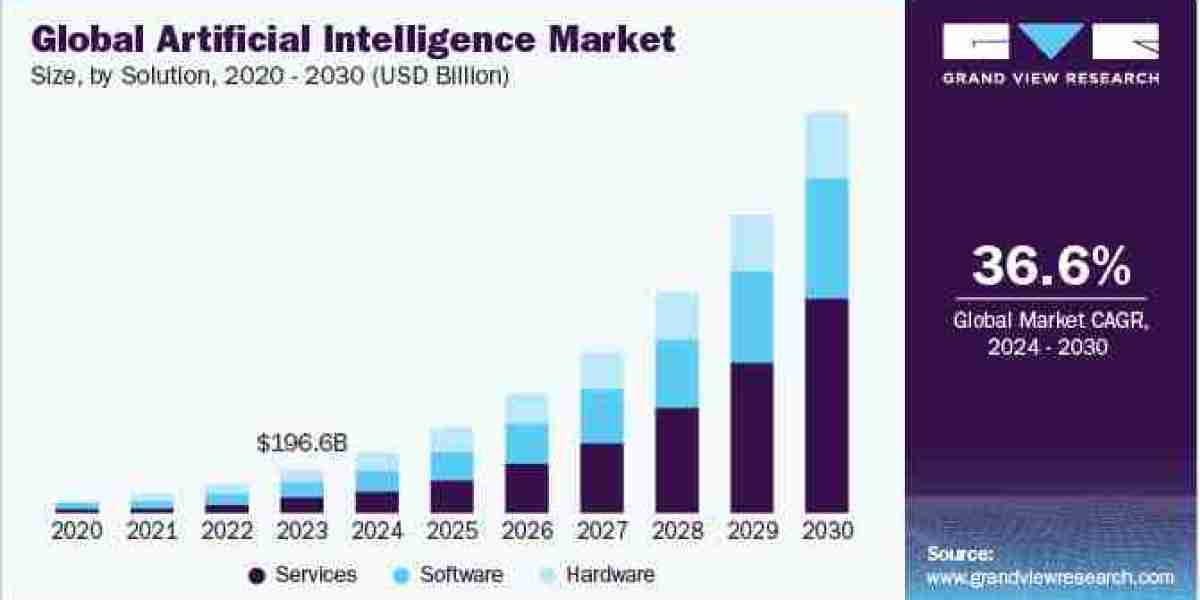

The global artificial intelligence market size was estimated at USD 196.63 billion in 2023 and is projected to grow at a CAGR of 36.6% from 2024 to 2030. The continuous research and innovation directed by tech giants are driving adoption of advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing. For instance, in December 2023, Google LLC launched ‘Gemini’, a large language AI model, made available in three sizes, namely, Gemini Nano, Gemini Pro, and Gemini Ultra. Gemini stands out from its competitors due to its native multimodal characteristic.

AI has proven to be a significant revolutionary element of the upcoming digital era. Tech giants like Amazon.com, Inc.; Google LLC; Apple Inc.; Facebook; International Business Machines Corporation; and Microsoft are investing significantly in research and development (R&D) of AI, thus increasing the artificial intelligence market cap. These companies are working to make AI more accessible for enterprise use cases. Moreover, various companies adopt AI technology to provide a better customer experience and improve their presence in the artificial intelligence industry 4.0.

Gather more insights about the market drivers, restrains and growth of the Artificial Intelligence Market

Detailed Segmentation:

End-use Insights

The advertising & media segment led the market and accounted for the largest revenue share in 2023. This is attributable to the growing application of AI marketing with significant traction. For instance, in January 2022, Cadbury started an initiative to let small business owners create their AD for free using the face and voice of a celebrity, with the help of an AI tool.

Solution Insights

Software solutions led the market and accounted for 35.8% of the global revenue in 2023. This leading share can be attributed to prudent advances in information storage capacity, high computing power, and parallel processing capabilities to deliver high-end services. The ability to extract data, provide real-time insight, and aid decision-making has positioned this segment to capture a significant portion of the market. Artificial intelligence software solutions include libraries for designing and deploying AI applications, such as primitives, linear algebra, inference, sparse matrices, video analytics, and multiple hardware communication capabilities. The need for enterprises to understand and analyze visual content to gain meaningful insights is expected to spur the adoption of artificial intelligence software over the forecast period.

Technology Insights

The deep learning segment led the market with the largest revenue share in 2023, owing to the growing prominence of the complicated data-driven applications of deep learning, including text/content or speech recognition. Deep learning offers lucrative investment opportunities as it helps overcome the challenges of high data volumes. Rising R&D investments by leading players will also play a crucial role in increasing the uptake of artificial intelligence technologies.

Function Insights

The operations segment accounted for the largest market revenue share in 2023. The operations segment is the engine room of a business, encompassing all day-to-day activities that deliver products or services to customers. Implementation of AI can automate repetitive tasks, such as data entry and order processing, improving efficiency and reducing errors. Furthermore, by using AI for predictive maintenance, process automation, and supply chain optimization, businesses can streamline workflows, reduce costs, and ensure the smooth delivery of their offerings.

Regional Insights

The North America AI market accounted for a revenue share of 30.9% in 2023. This can be attributed to favorable government initiatives to encourage the adoption of AI across various industries. Governments in North America are investing in AI research and development, establishing specialized research institutes and centers, and funding AI-related projects. They also utilize AI in many fields, such as enhancing public safety and transportation and promoting healthcare innovation.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

- The global IoT in utilities market size was estimated at USD 47.53 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030.

- The global robotic platform market size was estimated at USD 9.97 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030.

Key Artificial Intelligence Companies:

The following are the leading companies in the artificial intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices

- AiCure

- Arm Limited

- Atomwise, Inc.

- Ayasdi AI LLC

- Baidu, Inc.

- Clarifai, Inc.

- Cyrcadia Health

- Enlitic, Inc.

- Google LLC

- H2O.ai.

- HyperVerge, Inc.

- International Business Machines Corporation

- IBM Watson Health

- Intel Corporation

- Iris.ai AS.

- Lifegraph

- Microsoft

- NVIDIA Corporation

- Sensely, Inc.

- Zebra Medical Vision, Inc.

Artificial Intelligence Market Segmentation

Grand View Research has segmented the global artificial intelligence market based on solution, technology, function, end-use, and region:

Artificial Intelligence Solution Outlook (Revenue, USD Billion, 2017 - 2030)

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

Artificial Intelligence Technology Outlook (Revenue, USD Billion, 2017 - 2030)

- Deep Learning

- Machine Learning

- Natural Language Processing (NLP)

- Machine Vision

- Generative AI

Artificial Intelligence Function Outlook (Revenue, USD Billion, 2017 - 2030)

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

Artificial Intelligence End-use Outlook (Revenue, USD Billion, 2017 - 2030)

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

Artificial Intelligence Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa (MEA)

- KSA

- UAE

- South Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- Open AI is developing an innovative artificial general intelligence (AGI) model code-named Project Q-Star. The model could have an immense impact on the overall AI market and provide breakthroughs in interactions with technology, process automation, and solving a few of the world’s most pressing issues.

- In March 2024, Microsoft and NVIDIA announced a collaboration focused on advancing AI for the healthcare and life sciences industry. This partnership leverages the strengths of both companies: Microsoft Azure's cloud infrastructure and advanced computing capabilities, alongside NVIDIA's DGX Cloud and Clara suite. The goal is to accelerate innovation and improve patient care through developments in areas like clinical research and drug discovery.

- In March 2024, NVIDIA launched new Generative AI Microservices designed to advance medical technology (MedTech), drug discovery, and digital health. These microservices leverage artificial intelligence (AI) to potentially improve healthcare technology.

- In January 2024, Google unveiled a new AI model, Lumiere. It is a text-to-video diffusion model capable of generating short video clips based on text descriptions. It can also be used to animate still images or apply a specific style to video generation.

- In December 2023, Google LLC released a new large language model (LLM) called Gemini. Gemini comes in three versions: Nano, Pro, and Ultra. A key feature of Gemini is its ability to handle multiple modalities, which differentiates it from competing LLMs.

- In November 2023, The University of Cambridge, along with Intel Corporation and Dell Technologies announced the implementation of the co-designed fastest AI supercomputer ‘Dawn Phase 1’. Leading technical teams built the supercomputer that mobilizes the power of both high-performance computing (HPC) and artificial intelligence for solving some of the world’s most critical challenges. This is projected to accelerate the future technology leadership and inward investment into the UK technology sector.