Telemedicine Industry Overview

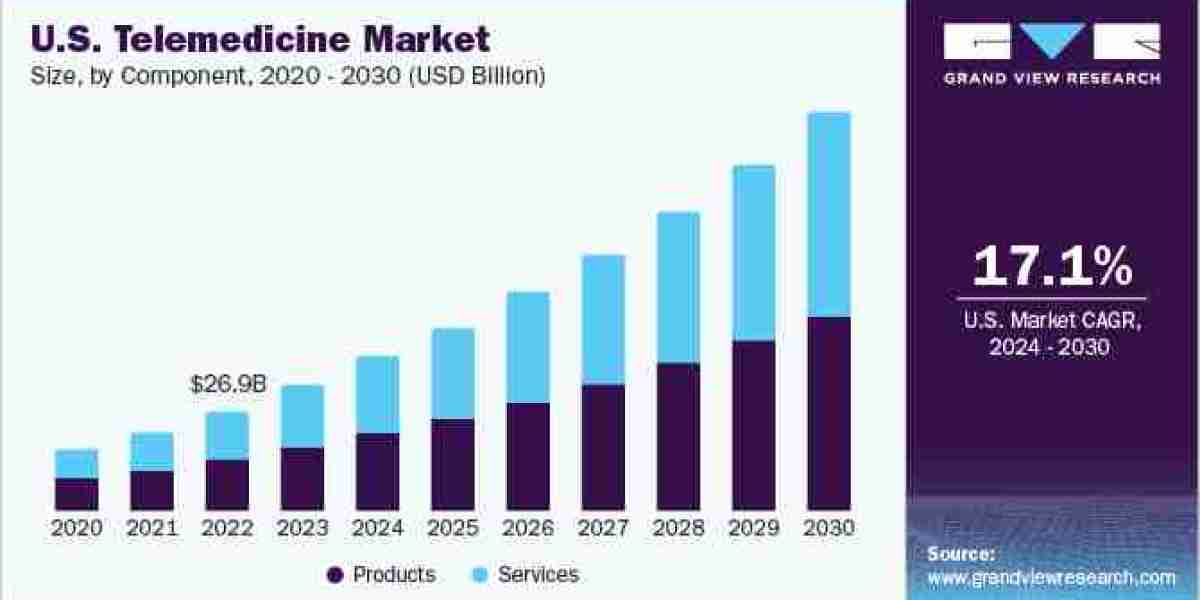

The global telemedicine market size was valued at USD 114.98 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.96% from 2024 to 2030. The telemedicine market growth is being driven by factors such as consolidation across industry, strategic initiatives by key companies, and increasing healthcare consumerism. Furthermore, rising adoption of telemedicine by providers, increasing patient acceptance and consumer demand, and delivery of improved quality of care are expected to contribute to the growth of the telemedicine market over the forecast period. For instance, in May 2021, Walmart Inc. acquired a telehealth company, MeMD. This acquisition is expected to enable Walmart to expand its offerings and provide virtual access to primary, urgent, and behavioral healthcare services nationwide.

According to statistics published by the GSM Association report, The Mobile Economy 2022, in 2021, number of people mobile users was 5.3 billion, and number of unique mobile subscribers is expected to reach 5.7 billion by 2025 (70% of the global population). In addition, penetration of smartphones is rising significantly.

Gather more insights about the market drivers, restrains and growth of the Telemedicine Market

Detailed Segmentation:

Component Insights

Product segment dominated the market and is further divided into software, hardware, and others. Product segment accounted for the largest market share of 51.97% in 2023. This can be attributed to the widespread adoption of various medical peripheral devices, audio equipment, microphones, display screens, and videoconferencing devices used to facilitate virtual visits. For instance, Teladoc Health, Inc. provides several devices, including Xpress & Xpress Cart, TV Pro & TV Pro+, Lite with Boom Camera, and Viewpoint Cart, to facilitate clinical collaboration and point-of-care visits. Similarly, NVIDIA CLARA is a powerful combination of software and hardware that brings advanced data analytics to medical imaging systems to advance disease diagnosis, detection, and treatment.

Modality Insights

Modality segment is divided into real-time (synchronous), store and forward (asynchronous), and other technologies such as remote patient monitoring. Real-time segment dominated the market in terms of revenue share in 2023. This growth can be attributed to increasing demand for on-demand medical consultations, adoption of mHealth and virtual video visits, and availability of services from major market players.

Application Insights

By application, market is segmented intoteleradiology, telepsychiatry, telepathology, teledermatology, telecardiology, and others. Teleradiology segment held largest revenue share of in 2023. As healthcare providers adopt teleradiology workflows, service offerings within radiology sub-segments expand, introduction of new teleradiology services, and teleradiology practices are regulated, this segment is expected to grow. For instance, in November 2021, Agfa Healthcare introduced a true remote diagnostic imaging workflow. Key growth drivers for this segment include integrating Artificial Intelligence (AI) into teleradiology, implementing a Picture Archiving and Communication System (PACS), and increasing R&D activities in eHealth. For instance, telemedicine service provider Heidelberg Medical Consultancy & Health Tourism Pvt. Ltd. specializes in providing customized, affordable, high-quality radiology reporting solutions for dental specialists and practices.

Delivery Model Insights

By delivery mode, market is segmented into web/mobile and call centers. Web/mobile segment accounted for largest revenue share in 2023 and is predicted to grow at fastest rate during the forecast period, owing to increasing prevalence of smartphone usage, mHealth adoption, and healthcare consumerism. This segment is further subdivided into audio/text-based and visualized access to care. Tech companies that provide mobile and web-based solutions are the key players in this segment. Rising adoption of visualized care delivery solutions and different strategies by market players, increasing user awareness, introducing technologically advanced solutions, and penetrating cloud-based solutions are expected to drive market growth. For instance, in January 2021, Koninklijke Philips N.V. signed an agreement to acquire Capsule Technologies, Inc. to expand its connected care segment portfolio and cloud based HealthSuite digital platform.

Facility Insights

By facility, market is divided into tele-hospitals and tele-home. Tele-hospitals segment accounted for largest revenue share in 2023. This growth can be attributed to government initiatives, rising patient awareness of health concerns, and widespread access to internet-based solutions. For instance, Koninklijke Philips N.V. has a Tele-ICU program allowing doctors to remotely monitor ICU beds. These beds have cameras and special tools to help predict what might happen to patients.

End Use Insights

By end use, market is divided into patients,payers,providers and others. In 2023, patients segment held largest market share. This can be attributed to patients using telemedicine services for various health issues, from mild to emergency situations. To cater to diverse needs of patients, market players such as VSee offer a range of solutions, including telemedicine software, remote patient monitoring dashboards, and API & SDKs across various clinical specialties. In addition, in March 2023, Koninklijke Philips N.V. launched Virtual Care Management, offering various flexible solutions and services to help health systems, payers, providers, patients, and employer groups connect with patients virtually anywhere.

Regional Insights

North America dominated the market with a revenue share of 33.53% in 2023. This can be attributed to region's advanced healthcare facilities, and a strong presence of key market players. Companies such as Teladoc Health, American Well Corporation, and Zoom Video Communications are based in the U.S., implementing strategic initiatives to increase their market share. Increasing home care adoption by patients, growing demand for mobile technologies, and increased healthcare expenditure are expected to drive the market's growth over the forecast period. For instance, according to the National Health Expenditure (NHE) Fact Sheet, the U.S. spent USD 4.5 trillion on healthcare in 2022.

Browse through Grand View Research's Category Healthcare IT Industry Research Reports.

- The global cloud-based dental practice management software market size was valued at USD 721.0 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.4% from 2024 to 2030.

- The global ambient assisted living (AAL) market size was valued at USD 7.36 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 26.8% from 2024 to 2030.

Key Companies & Market Share Insights

Renowned market players across the globe are adopting numerous marketing strategies to expand their clientele. The telemedicine marketplace is fragmented and accommodates some renowned players such as MDlive, Inc. (Evernorth), American Well Corporation, and Teladoc Health, Inc. and numerous other small-scale & local players.

- MDLive Inc. is a telehealth and on-demand healthcare provider with services that cater to patients, hospitals, healthcare providers, employers, etc. The virtual care cloud-based platform of the company allows easy collaboration between providers and patients, bridging the gap in care delivery.

- American Well Corporation is a major telehealth solutions company providing accessible, affordable, quality care to individuals through its innovative platform and services. The company develops innovative solutions for individuals, insurers, and healthcare providers to create access to better healthcare solutions.

- Teladoc Health, Inc. has more than 12,000 clients across the globe and provides virtual care, such as mental health, primary care, and chronic condition management.

- Doctor On Demand, Inc. (Included Health), NXGN Management, LLC, and Zoom Video Communications, Inc. are some of the emerging market players in telemedicine market.

- Doctor On Demand, Inc. provides virtual healthcare solutions to patients in remote locations. The solutions provide guidance, advocacy, and access to personalized care through virtual & in-person medical assistance for primary care, urgent care, specialty care, chronic disease care, preventive health, and behavioral health.

- NXGN Management, LLC provides advanced healthcare technology and data solutions that empower providers to deliver comprehensive care and value-based services to patients.

Telemedicine Market Segmentation

Grand View Research has segmented the global telemedicine market based on component, modality, application, delivery mode, facility, end-use, and region:

Telemedicine Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

Telemedicine Modality Outlook (Revenue, USD Billion, 2018 - 2030)

- Store and forward

- Real time

- Others

Telemedicine Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

Telemedicine Delivery Mode Outlook (Revenue, USD Billion, 2018 - 2030)

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

Telemedicine Facility Outlook (Revenue, USD Billion, 2018 - 2030)

- Tele-hospital

- Tele-home

Telemedicine End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Providers

- Payers

- Patients

- Others

Telemedicine Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North Americ

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Telemedicine Companies:

- MDlive, Inc. (Evernorth)

- American Well Corporation

- Twilio Inc.

- Teladoc Health, Inc.

- Doctor On Demand, Inc. (Included Health)

- Zoom Video Communications, Inc.

- SOC Telemed, Inc.

- NXGN Management, LLC

- Plantronics, Inc.

- Practo

- VSee

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In June 2023, Twilio Inc. declared a partnership with Frame AI to leverage AI for the enhancement of customer engagement. The partnership resulted in the strengthening of AI-powered insights for sharing recommendations, and summarizing health cases.

- In April 2023, Teladoc Health Inc. launched a provider-based care service with the use of telemedicine as a technology for prediabetes and weight management programs.

- In March 2023, American Well Corporation expanded its digital clinical program service for the inclusion of a cardiometabolic program. The purpose is to enable clinicians and health plans to patients remotely through telemedicine.

- In January 2023, Sesame Inc. partnered with Lucira Health for providing telemedicine services to access affordable, convenient, and high quality COVID-19 test and treatment.

- In November 2022, MDLIVE announced its rapid expansion in providing primary virtual care program for enhancing support for patients suffering from chronic illness. The purpose is to provide patients with convenient and seamless access to medical care through telemedicine.

- In September 2022, Doxy.me Inc. extended its telemedicine service reach to 88% of the global population wherein patients can get access to remote health facilities in more than 100 languages.

- In March 2022, Plantronics Inc., renamed as Poly, announced its partnership with Raydiant for making advancements in telemedicine services. The purpose was to optimize remote, hybrid, and in-office team communication for facilitating health communication.