Data Center Colocation Industry Overview

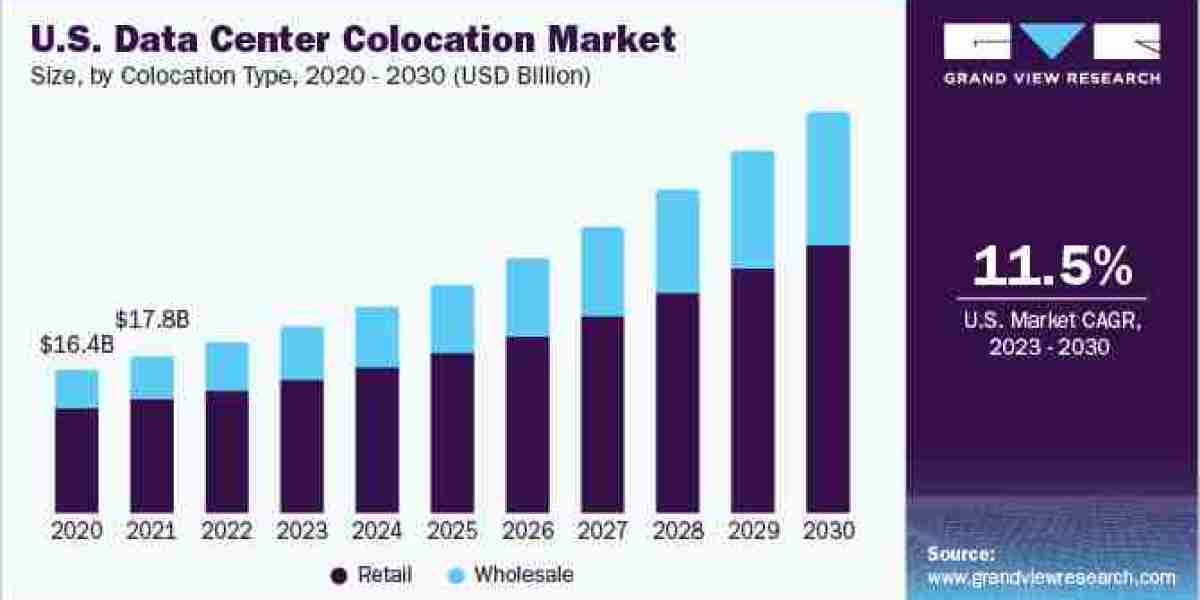

The global data center colocation market size was valued at USD 54.82 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2030. Data centers are a major part of modern corporate practices responsible for administering business applications. The need for IT infrastructure for running businesses has increased over the years as businesses become more dependent on data, which has further resulted in the higher adoption of cloud services. Colocation data centers have enabled quick scaling up of IT requirements of businesses. Moreover, higher costs of owning and maintaining data centers, for companies to generate inconsistent data volumes, have been a key factor driving the market growth.

Gather more insights about the market drivers, restrains and growth of the Data Center Colocation Market

The emergence of technologies, including cloud computing, autonomous vehicles, Internet-of-Things (IoT), and advanced robotics, has resulted in a higher demand for faster data processing and higher bandwidth. The successful usage of these technologies requires lower latency and faster network connectivity. Colocation data centers are best suited to meeting low latency and faster network connectivity requirements as the operators can locate their data center facilities that are nearby to the users, enabling them to offer greater storage and networking services. The emergence of 5G technology is expected to increase the deployment of colocation services, owing to the capability of colocation providers to offer services in remote locations.

The increasing adoption of cloud data centers, attributed to reduced costs, is expected to fuel market growth. SMEs are increasingly adopting cloud services owing to factors, such as eliminating the need for IT staff, scalable low costs, and having lesser overheads. Several major companies in the market have been developing various strategic initiatives, including partnerships, acquisitions, and mergers, among others, to get better traction in the market. For instance, in May 2022, Cyxtera announced its colocation solution offerings in India, achieved by a strategic partnership with Sify Technologies Ltd. As a part of the partnership, Sify Technologies Ltd. will resell Cyxtera’s solutions across markets in Asia Pacific, Europe, and North America to more than 10,000 customers.

The customers will also be able to access Digital Exchange, enabling companies to deploy every IT infrastructure on-demand and providing the foundation for modernizing operations to compete in the digital world. The emergence of technologies, such as 5G, AR, VR, and AI, has also resulted in high demand for allocating higher bandwidths for data sharing between businesses. Moreover, the need for data center colocation has increased due to the continued adoption of various technologies, such as advanced robotics and autonomous vehicles. These technologies' constant expansion has contributed equally to the adoption of smart devices, thereby driving the need for lower latency. Colocation enables cloud service providers to set up their data centers in proximity to users, enabling low latency and high bandwidth in data transfer.

Browse through Grand View Research's Communications Infrastructure Industry Research Reports.

- The global cloud computing market size was estimated at USD 602.31 billion in 2023 and is expected to grow at a CAGR of 21.2% from 2024 to 2030.

- The global autonomous vehicle market size was valued at USD 42.37 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 21.9% from 2023 to 2030.

Data Center Colocation Market Segmentation

Grand View Research has segmented the global data center colocation market based on colocation type, tier level, enterprise size, end-use, and region:

Data Center Colocation Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Retail

- Wholesale

Data Center Colocation Tier Level Outlook (Revenue, USD Billion, 2018 - 2030)

- Tier 1

- Tier 2

- Tier 3

- Tier 4

Data Center Colocation Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

Data Center Colocation End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Retail

- BFSI

- IT & Telecom

- Healthcare

- Media & Entertainment

- Others

Data Center Colocation Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- S.

- Canada

- Europe

- UK

- Germany

- France

- Austria

- Switzerland

- Benelux

- Nordics

- CEE

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Key Companies profiled:

- China Telecom Corporation Ltd.

- Cologix

- Colt Technology Services Group Ltd.

- CoreSite

- CyrusOne

- Cyxtera Technologies, Inc.

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- Iron Mountain Inc.

- NTT Ltd.

- QTS Realty Trust, LLC

- Rackspace Technology

- Telehouse

- Zayo Group, LLC

Order a free sample PDF of the Data Center Colocation Market Intelligence Study, published by Grand View Research.