Cancer Diagnostics Industry Overview

The global cancer diagnostics market size was estimated at USD 107.45 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.16% from 2024 to 2030.

The growth of this industry is attributed to the growing prevalence of cancer, technological advancements in diagnostics procedures, and rising initiatives undertaken by private and public organizations. Moreover, increasing initiatives to develop novel imaging solutions for providing more accurate and precise diagnoses are anticipated to fuel market growth over the forecast period. For instance, in September 2022, Radiopharm Theranostics entered into collaboration with The University of Texas MD Anderson Cancer Center for the launch of Radiopharm Ventures, LLC involved in the development of novel radiopharmaceutical products.

Global rise in the prevalence of cancer is one of the major factors facilitating market growth. For instance, according to the Pan American Health Organization (PAHO), an estimated 20 million new cases and 10 million deaths are expected in 2023, and annual reported cases are expected to reach about 30 million by 2040. The need for development of diagnostics options that can detect the disease at an early stage, and help improve disease management and reduce mortality, is likely to propel market growth. It is also indicated that one in six women and one in five men are likely to develop cancer at some point in their lives.

Gather more insights about the market drivers, restrains and growth of the Cancer Diagnostics Market

In addition, the 5-year prevalence was around 50.5 million in 2020. Personalized medicine is expected to change the diagnosis and care delivery landscape as treatment planning is based on data obtained through a holistic approach.Major companies operating in the personalized medicine space are involved in several investment programs pertaining to precision medicine. Furthermore, companies providing molecular decision support systems are combining genomic data with clinical data to minimize gaps in precision medicine practice. However, cancer diagnostic tests are expensive, increasing the financial burden on families of patients.

The government insurance framework is not as well-defined in developing countries as it is in developed countries. Thus, the middle-class patient population who are not covered under any insurance (private or government) cannot afford these tests. Furthermore, many private insurance companies in developing countries do not cover the costs associated with diagnosis. As a result, the high cost of diagnosis is limiting the adoption of screening tools, especially in developing countries.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports

- The global hepatitis E diagnostic tests market size was estimated at USD 54.75 million in 2023 and is projected to grow at a CAGR of 4.77% from 2024 to 2030.

- The global tuberculosis diagnostics market sizewas valued at USD 2.19 billion in 2023 and is projected to grow at a CAGR of 5.97% from 2024 to 2030.

Cancer Diagnostics Market Segmentation

Grand View Research has segmented the global cancer diagnostics market based on product, type, application, end-use, test type, and region:

Cancer Diagnostics Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Instruments

- Pathology-based Instruments

- Slide Staining Systems

- Tissue Processing Systems

- Cell Processors

- PCR Instruments

- NGS Instruments

- Microarrays

- Other Pathology-based Instruments

- Imaging Instruments

- Others

- Pathology-based Instruments

- Consumables

- Antibodies

- Kits & reagents

- Probes

- Others

- Services

Cancer Diagnostics Type Outlook (Revenue, USD Billion, 2018 - 2030)

- IVD

- By Type

- Diagnosis

- Early Detection

- Therapy Selection

- Monitoring

- By Technology

- Polymerase Chain Reaction (PCR)

- In Situ Hybridization (ISH)

- Immunohistochemistry (IHC)

- Next-generation Sequencing (NGS)

- Microarrays

- Flow Cytometry

- Immunoassays

- Other IVD Testing Technologies

- LDT

- Imaging

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Positron Emission Tomography (PET)

- Mammography

- Ultrasound

- Others

- By Type

Cancer Diagnostics Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Breast Cancer

- Colorectal Cancer

- Cervical Cancer

- Lung Cancer

- Prostate Cancer

- Skin Cancer

- Blood Cancer

- Kidney Cancer

- Liver Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Others

Cancer Diagnostics End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Laboratories

- Others

Cancer Diagnostics Test Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Biopsy

- Fine-needle Aspiration

- Core Biopsy

- Surgical Biopsy

- Skin Biopsy /Punch Biopsy

- Others

- Others

Cancer Diagnostics Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

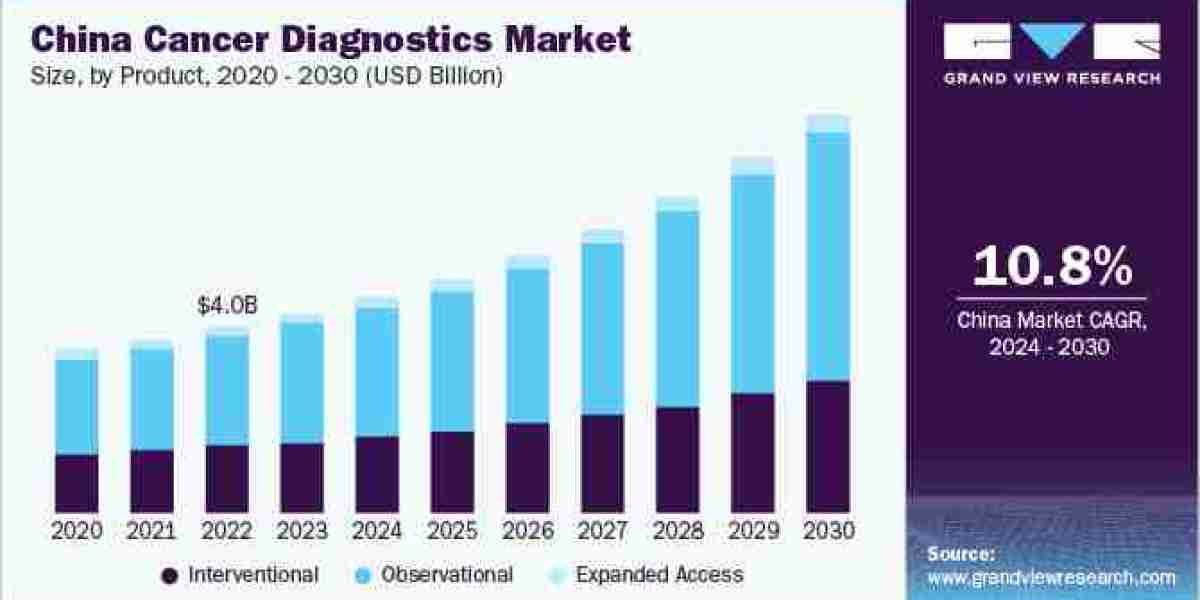

- China

- Japan

- India

- Thailand

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Teijin Limited

- Yantai Tayho Advanced Materials Co., Ltd.

- DuPont

- Kolon Industries, Inc.

- HYOSUNG ADVANCED MATERIALS

- TAEKWANG Industrial Co., Ltd.

- Davy Textiles Ltd.

- AFCHINA

- Artec

- Guangzhou Green New Materials Co., Ltd.

Key Companies & Market Share Insights

Some of the key players are adopting strategies, such as acquisitions and collaborations, to strengthen their presence in other regional markets. This can lead to improved product development, operational efficiencies, or expanded market reach. Companies are undertaking various strategies, such as M&As, collaborations, partnerships, etc., to gain higher market share. For instance:

- In February 2023, F. Hoffmann-La Roche announced expanding its collaboration with Janssen to advance personalized healthcare by focusing on companion diagnostics

- In April 2023, Quest Diagnostics acquired Haystack Oncology in an all-cash deal to expand MRD testing services, initially targeting colorectal, breast, and lung cancers, aiming to enhance patient outcomes through early MRD detection after treatment

- In June 2023, Blue Earth Diagnostics received FDA approval for high-affinity radio hybrid (rh) Prostate-Specific Membrane Antigen (PSMA)-targeted PET imaging agent, POSLUMA, for prostate cancer detection and localization. It's based on innovative radio hybrid technology, providing accurate imaging and potential therapeutic applications

Order a free sample PDF of the Cancer Diagnostics Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research Helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com