Nitrogen Procurement Intelligence

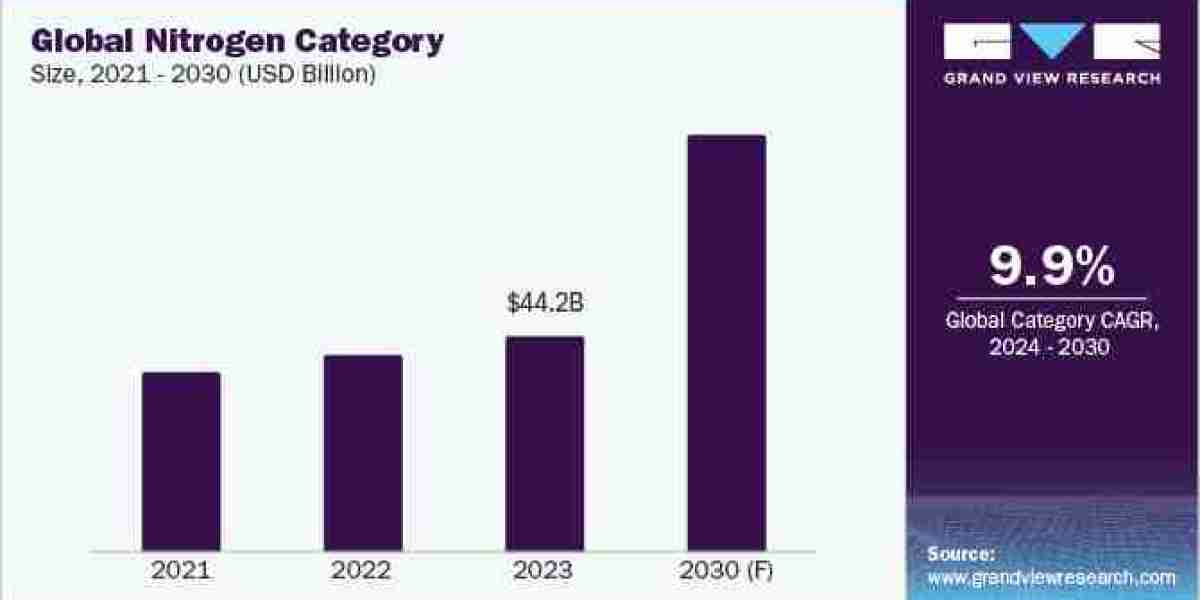

The nitrogen category is anticipated to witness growth at a CAGR of 9.9% from 2024 to 2030. Asia Pacific dominates the global category, followed by North America and Europe. In the upcoming years, North America's share in the global market is anticipated to rise steadily, holding a substantial position in the industry. The region showcases a significant presence in food & beverage, pharmaceutical, oil & gas, and manufacturing sectors which yields high demand for the products offered in the category, for applications in inerting, purging, and blanketing. The United States and Canada are some of the key countries generating demand due to their developed industrial infrastructure and cutting-edge technological innovations. In addition, countries such as the Netherlands, the United Kingdom, France, and Germany are the top markets in Europe.

Future growth of the category is expected to be aided by the expanding population and growing need for crop yield. Nitrogen, a vital component of fertilizers that is essential to enhancing agricultural productivity to meet food and resource requirements, is in high demand due to the world's population growth and rising crop yield. For instance, in 2022, the U.S. Census Bureau reported that the number of people living in the U.S. had increased by 0.39%, or 1,255,999, to 333,287,549. In addition, products offered in the category are utilized in the electronics sector to offer a moisture- and oxygen-free atmosphere throughout different production processes, such as the manufacturing of printed circuit boards, semiconductors, and other electronic parts. It helps minimize the oxidation of delicate materials, improves the dependability and quality of electronic equipment, and stops flaws from forming.

Technologies such as membrane separation, artificial intelligence (AI), and internet of things (IoT) are witnessing higher adoption in the category. Membrane separation / membrane nitrogen generation divides the air's component gases using hollow-fiber membranes. Greater surface area is available for quicker permeation because of the membrane's special shape, which consists of hollow fibers. In order to separate the gases, atmospheric air must be drawn into the generator, compressed, and run through a number of filters. After being compressed, the air is passed through a high-efficiency filter to eliminate any remaining particle matter and water vapor. In addition, gas distribution and delivery are optimized through the application of AI algorithms, which lower costs and raise customer satisfaction. The technology supports in determining the maintenance of gas plants by assessing data from the equipment.

Order your copy of the Nitrogen category procurement intelligence report 2024-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Nitrogen Sourcing Intelligence Highlights

- The nitrogen category exhibits a moderately fragmented landscape, with the presence of a large number of global and regional market players having intense competition.

- The threat of new entrants is low, subject to factors such as high capital requirement, existing competition, regulatory compliance, and technological expertise.

- Belgium is the preferred low-cost/best-cost country for sourcing nitrogen suppliers. In Q4 2023, Belgium's nitrogen imports and exports totaled up to €220k and €2.08M, respectively. This led to a positive trade balance of €1.85 million.

- Raw material/feedstock, labor, machinery & equipment, energy, storage & transportation, and others are the major cost components of the nitrogen category. Other costs can be further bifurcated into administrative fees, rent, maintenance & repair, depreciation, interest on loan, and tax.

List of Key Suppliers

- ADNOC Gas

- Air Products and Chemicals, Inc.

- BOC Limited

- Gulf Cryo

- L’Air Liquide S.A.

- Linde plc

- Messer SE & Co. KGaA

- nexAir, LLC

- Praxair, Inc.

- Southern Industrial Gas Sdn Bhd

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

- Yingde Gases Group Company Limited

Browse through Grand View Research’s collection of procurement intelligence studies:

- Pressure Vessels Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Business Intelligence Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Nitrogen Category Procurement Intelligence Report Scope

- Nitrogen Category Growth Rate: CAGR of 9.9% from 2024 to 2030

- Pricing Growth Outlook: 5% - 10% increase (Annually)

- Pricing Models: Cost-plus pricing, fixed pricing

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: Geographical service provision, industries served, years in service, employee strength, revenue generated, certifications, form of delivery (compressed gas / liquid), product concentration & purity, technology deployed for production, on-site generation, regulatory compliance in storage & transportation, lead time, and others

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions