LDPE Procurement Intelligence

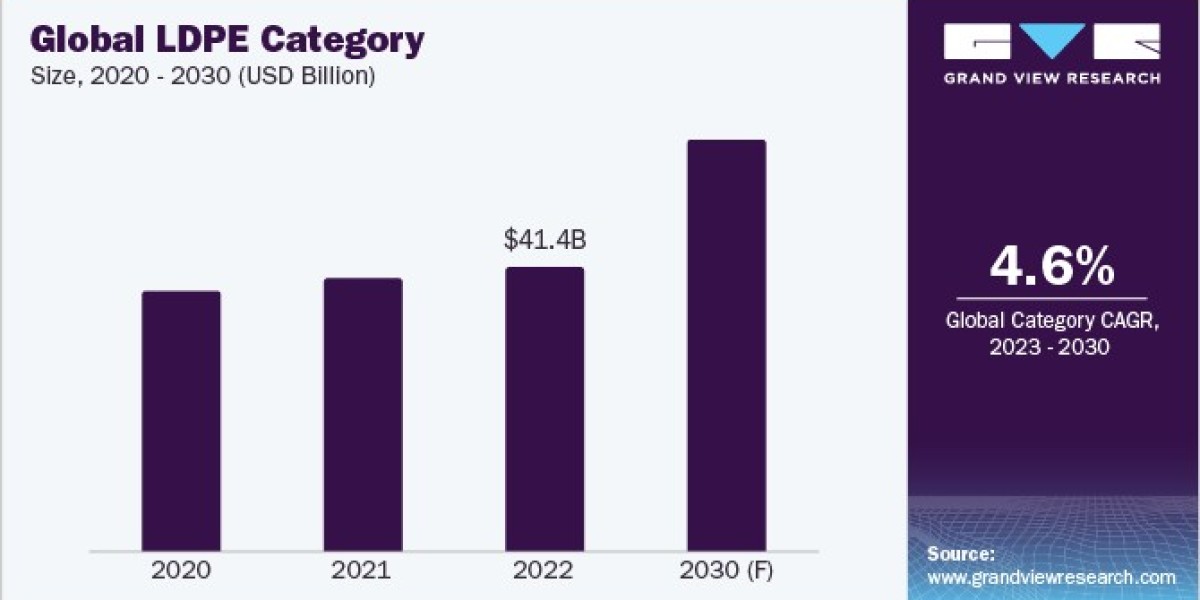

The LDPE category is expected to grow at a CAGR of 4.63% from 2023 to 2030. The increasing demand for sustainable packaging materials in the polymers and plastics industry is driving the growth of low-density polyethylene. One of the emerging trends is the increasing preference for biobased polymers in LDPE. Packaging waste has unavoidably increased as e-commerce has grown. There is a growing focus on recycling LDPE, HDPE, and plastic waste to create new recycled high-performance LDPE pellets or films. There is an increase in vendor partnerships and collaborations to utilize advanced recycling processes to reduce the CO2 emissions generated during the production of these polymers.

Companies such as Dow Chemical and DuPont, for instance, are focusing on creating packaging materials that can be recycled from the very beginning. For instance, Dow Chemical has been P&G's external business partner since 2019. Recently, in June 2023, P&G China partnered with Dow Chemical to create environmentally sustainable e-commerce packaging, the “air capsule” which uses 40% less material compared to other traditional packaging. This will enable customers to close the loop on packaging waste.

In 2022, in terms of LDPE consumption, Mainland China was the leading country, accounting for 30 – 35% of the total share, followed by Western and Central Europe. 2022 saw LDPE account for 22% of the total demand for polyethylene. The combined demand for LDPE and LLDPE accounted for 56% of the total demand for polyethylene in 2022. Between 2019 and 2022, the highest producers of polyethylene worldwide were the U.S., China, the Middle East, and a few Western European countries.

Changes in the prices of energy also have a significant impact on the total cost of LDPE production. This is because, in many cases, the production of high-pressure co-polymers that utilize LDPE can increase energy consumption which in turn can increase the total cost. Machinery is another vital factor in cost considerations. For instance, a single cavity for injection molding can range between USD 3,000 - 6,000, whereas multi-cavity machines can cost as high as USD 90,000 depending on the scale of production capacity. Both injection molding and extrusion molding technologies are very mature, and suppliers mainly focus on cost reduction, increasing plant scale, and product enhancements.

Order your copy of the LDPE category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

LDPE Sourcing Intelligence Highlights

- The LDPE category is consolidated. The top eight to twelve players dominate the category and account for between 40 – 50% of the total share. However, regionally in China, the industry is currently fragmented.

- The threat of new entrants is moderate to low as companies need a high initial investment to launch a polymer or petrochemical-related product. The threat of substitutes is currently moderate as there is a rise in bio-based polymers. One of the key substitutes available in the market is also LLDPE.

- The largest cost components in this category are raw materials, labor, energy, equipment and machinery.

- In the Asia Pacific and the Middle East region, some of the significant producing countries of polyethylene are Japan, Thailand, Qatar, Saudia Arabia, and the U.A.E. In terms of domestic production, China produced 25.3 million tons of ethylene in 2022.

List of Key Suppliers

- The Dow Chemical Company

- LyondellBasell Industries N.V.

- SABIC

- Chevron Phillips Chemical

- BASF SE

- ExxonMobil Corporation

- LG Chem Ltd

- Westlake Corporation

- Formosa Plastics Corporation

- China Petroleum & Chemical Corporation (Sinopec)

- INEOS AG

- Dupont De Nemours Inc.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Yacht Charter Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Vaccines Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

LDPE Procurement Intelligence Report Scope

- LDPE Category Growth Rate : CAGR of 4.63% from 2023 to 2030

- Pricing Growth Outlook : 10% - 12% (Annually)

- Pricing Models : Volume-based, contract-based, spot-price based

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Production capacity, grade types, LDPE characteristics (temperature, density and melt index), ASTM methods, operational capabilities, quality measures, certifications, data privacy regulations, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions