HVAC Systems Procurement Intelligence

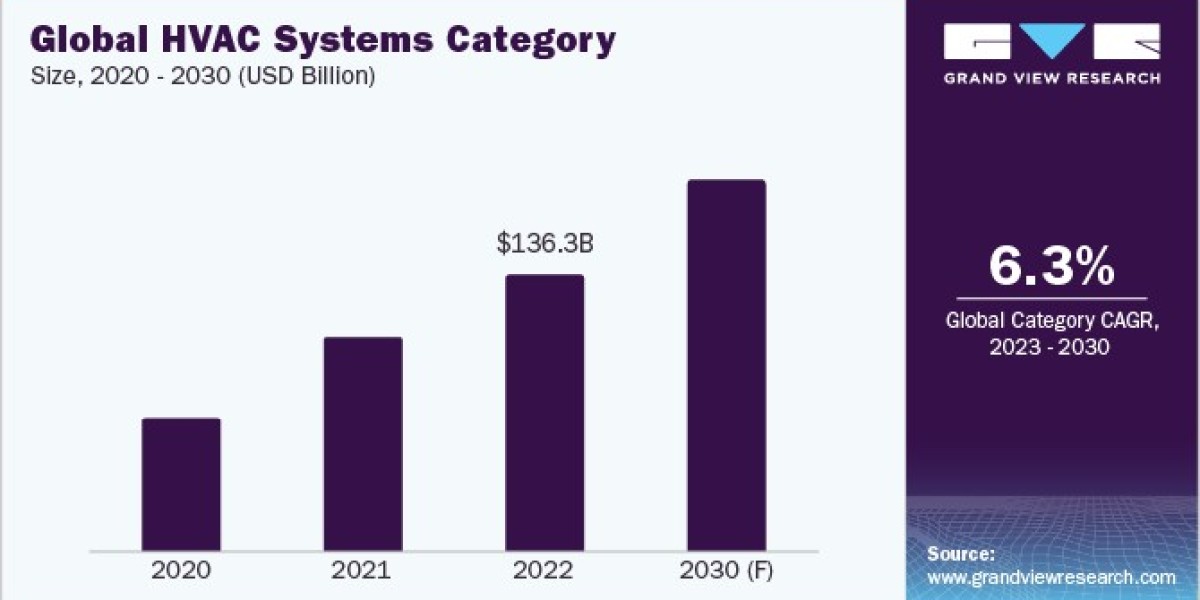

The global HVAC systems category is expected to grow at a CAGR of 6.3% from 2023 to 2030. Office buildings and high-rise structures are increasingly using HVAC systems to control the temperature within the buildings. As a result of growing environmental concerns, there is a rising trend for green buildings, which is in turn expected to drive category growth. In APAC and the Middle East region, the demand for HVAC systems for residential purposes is growing due to its hot climate conditions. The growing number of building permits and enhanced designs in construction are driving the demand for AC.

The shift of HVAC system maintenance from reactive to predictive maintenance is enabled by the use of IoT technology. Predictive maintenance lengthens the lifespan of the HVAC system while lowering labor and maintenance costs. The traditional Building Management System (BMS) is made up of various subsystems that are installed inside a building office. Only staff members who work in facility management or building management are given access to each organization's unique IT infrastructure. Whereas IoT technologies can be relatively cheaper to install in any type of building over traditional BMS systems. It can be accessible to other building assets such as lighting and security, which transform the facility management services. For instance, voice and light sensors in a meeting room can indicate when the conference is over, and cleaning is needed. The IoT software automatically creates a work order for cleaning, negating the need for human involvement. Facility managers can remotely check the status of these work orders from their desks or while traveling by using mobile applications.

Order your copy of the HVAC Systems category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on new acquisitions, product development, and service enhancement. For instance,

- In February 2023, Armstrong Fluid Technology, a Canada-based company, announced a partnership with Hydronic System Optimisation (officially known as Hysopt), a Belgium-based company, for HVAC digital twin modeling. This collaboration offers customers more reliable scientific simulation and verification of HVAC system energy and carbon savings by integrating Hysopt's advanced technology and Armstrong's vast installation capability.

- In April 2022, collaboration was announced between Carrier Global Corporation and ACI Mechanical and HVAC Sales company for a suite of applied equipment and variable refrigerant flow (VRF) HVAC systems. The applied products are consolidated with stringent energy codes in Washington. The stringent energy codes in Washington can offer an acceptable level of energy efficiency while permitting some flexibility in building design, construction, and heating equipment efficiency. This partnership will enhance ACI Mechanical and HVAC Sales company's solutions, which can provide high-performance HVAC systems and support sustainability.

HVAC Systems Sourcing Intelligence Highlights

- The threat of new entrants in HVAC systems is low as the category is highly capital-intensive which requires substantial investment for various activities such as marketing, distribution, manufacturing, as well as for research and development purposes. In addition, leading players in this category tend to create difficulty for new firms to enter because major players benefit from intellectual property, economies of scale, and customer loyalty.

- The industry is highly fragmented and encompasses several major players such as Carrier Corporation; Daikin Industries, Ltd., Johnson Controls International plc, and Trane Technologies. This fragmentation is often driven by technological advancement focusing on energy-efficient, smart connected systems, smart homes, and sustainable HVAC systems.

- The category’s growth is boosted owing to the adoption of various innovative trends and advancements in technology such as smart HVAC technology, IoT, automation software to enhance operation, geothermal and ductless HVAC systems, zoning systems, and others.

- Operating cost, equipment cost, replacement cost, installation cost, and disposal cost are some of the cost components involved in HVAC systems. Other additional costs involved are insulation, asbestos removal, location of systems, SEER (seasonal energy efficiency ratings), AFUE (annual fuel utilization efficiency) rating, and permit cost. The operating cost consists of labor, maintenance, utility costs, cost of HVAC parts, and others.

List of Key Suppliers

- Arkema Group

- Carrier Corporation

- Daikin Industries, Ltd.

- Emerson Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Johnson Controls International Plc

- Lennox International, Inc.

- Mitsubishi Electric Corporation

- Trane Technologies

Browse through Grand View Research’s collection of procurement intelligence studies:

- Advertising Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Digital Procurement Systems Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

HVAC Systems Procurement Intelligence Report Scope

- HVAC Systems Category Growth Rate : CAGR of 6.3% from 2023 to 2030

- Pricing Growth Outlook : 3% - 5% (Annually)

- Pricing Models : Flat-rate pricing

- Supplier Selection Scope : End-to-end service, cost and pricing, compliance, service reliability, and scalability

- Supplier Selection Criteria : Equipment, implementation, HVAC technology, certification, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions