Customs Brokerage Service Procurement Intelligence

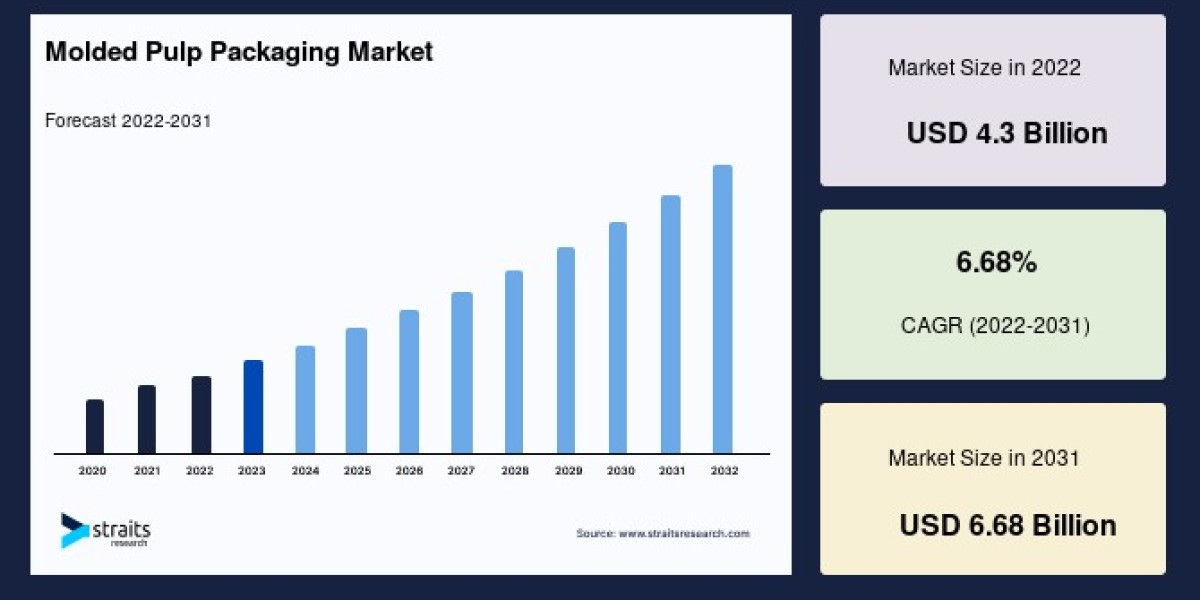

The customs brokerage service category is expected to grow at a CAGR of 7.7% from 2023 to 2030.

North America held the largest revenue share in 2022 due to a number of factors, including significant industry players' presence, technological developments, and rapid expansion in a variety of sectors, including manufacturing, healthcare, and retail. The dominance of the region can be linked to the existence of developed nations like the United States and Canada, where these industries are rapidly expanding. Trade with other nations is facilitated by collaboration and partnerships among the major market participants, and trade in this region is also increasing thanks to the region's modern infrastructure, which includes effective land, sea, and airport services.

E-commerce is driving the growth of the customs brokerage services category. The increasing availability of broadband internet, the growing popularity of mobile devices, and the convenience of shopping online are all factors that are driving the growth of e-commerce. As businesses ship more goods to customers around the world, they need to clear those goods through customs. This is where customs brokerage services come in. Customs brokers help businesses navigate the complex customs regulations of different countries and ensure that goods are cleared quickly and efficiently.

Order your copy of the Customs Brokerage Service category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on collaborating for instance,

- In April 2023, Worldwide Logistics Group (WWL), a global integrated logistics provider, completed the acquisition of P. W. Bellingall, Inc. (PWB), a major customs brokerage house located in San Francisco. This acquisition will give WWL a significant presence in the cross-border trade between the United States Asia and will expand its reach into the San Francisco Bay Area.

- In June 2022, Parade, a software provider for freight brokerage, integrated its truckload capacity management platform with Covenant Logistics Group, Inc. By bridging the technical gap and facilitating a more seamless shift from manual to digital freight bookings, this partnership will aid Covenant's freight brokerage operations. This will increase operational effectiveness and enable Covenant to adjust to the shifting business environment.

Digitization, automation, value-added services, trade facilitation programs, e-commerce boom, and growing markets are all contributing to this category's expansion. Customs brokers can expedite procedures, cut expenses, and improve service quality due to these considerations. Risk analysis, trade advice, and supply chain management are examples of value-added services. Initiatives to facilitate trade make it easier to deal with customs, and e-commerce is expanding to serve online buyers and sellers.

Customs Brokerage Service Sourcing Intelligence Highlights

- The global customs brokerage service category is highly fragmented with the presence of several players including multinational logistics companies, specialized customs brokerage firms, and freight forwarders. To grow their market share, firms in the industry are adopting crucial strategies like acquisitions, partnerships, and regional expansion.

- In this category, buyers have more bargaining power when there are many suppliers to choose from, it is easy and inexpensive to switch suppliers, and the customs brokerage service is not essential to the buyer's business. In contrast, suppliers have more bargaining power when there are few suppliers to choose from, it is difficult and expensive to switch suppliers, and the customs brokerage service is essential to the buyer's business.

- China, India, and the United States are the most preferred destinations for sourcing customs brokerage services in this category.

- Specialized firms offer customs brokerage services and have strong relationships with customs officials, enabling them to expedite the clearance process. Freight forwarders, on the other hand, handle the transportation of goods and provide customs brokerage services.

List of Key Suppliers

- Kuehne+Nagel

- United Parcel Service of America Inc

- CEVA Logistics

- APL Logistics Ltd

- Expeditors International of Washington Inc

- Nippon Express Holdings

- Deutsche Post DHL Group

- FedEx

- CJ Logistics Corporation

- DB Schenker

Browse through Grand View Research’s collection of procurement intelligence studies:

- Construction Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Advertising Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Artificial Intelligence Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Customs Brokerage Service Procurement Intelligence Report Scope

- Customs Brokerage Service Category Growth Rate : CAGR of 7.7% from 2023 to 2030

- Pricing Growth Outlook : 10% - 15% (Annually)

- Pricing Models : Cost-plus pricing and value-based pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Technical expertise, experience, cost and quality of service, capabilities and reliability, customer service

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions