Zero Trust Security Industry Overview

The global zero trust security market size was estimated to be USD 24.84 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 16.6% from 2023 to 2030. The growth of the zero trust security industry can be attributed to various factors, such as the growing trend in CYOD and BYOD concepts, increasing the number of cyber attacks, and improving regulation concerning cybersecurity, among others. The popularity of Bring Your Own Device (BYOD) and Choose Your Own Device (CYOD) trends is increasing significantly across organizations. Major Advantage, such as cost reduction on the endpoint infrastructure procurement front, has been driving the growth of zero-trust security. Moreover, the improvements in employee productivity ensured by allowing them to work on familiar devices drive the popularity of such concepts. The BYOD concept attained a reputation during the COVID-19 pandemic as organizations embraced the remote working model.

However, the BYOD and CYOD models allow employees to access business information and cloud applications using their dedicated endpoints, increasing the chances of data theft. Traditional cyber security measures fall short of preventing all forms of malware attacks or Advanced Persistent Threats (APT). Moreover, sophisticated cyber threat actors continuously monitor ways to penetrate through company networks, making it necessary for organizations to strengthen their cyber security infrastructure with zero trust methodologies.

Gather more insights about the market drivers, restrains and growth of the Zero Trust Security Market

Detailed Segmentation:

Security Type Insights

The endpoint security segment of the market by security type is projected to occupy the largest share, holding over 25% in 2022. The growth of the endpoint segment can be attributed to its benefits which include improved patch management, preventing insider threats, filtering content web, reducing AI threats, and streamlining cybersecurity, among others. Moreover, the companies in the market have been developing an enhanced solution to get better traction. The companies are involved in various strategic initiatives, including partnerships,s acquisitions, and mergers. For instance,e in January 2023, Xcitium cybersecurity provider announced a partnership with Carrier SI, a communication solution provider. The partnership is aimed at offering enhanced and affordable endpoint security. Moreover, the Carrier SI customers will now have access to the endpoint cybersecurity technology capable of containing known and unknown cyberattacks.

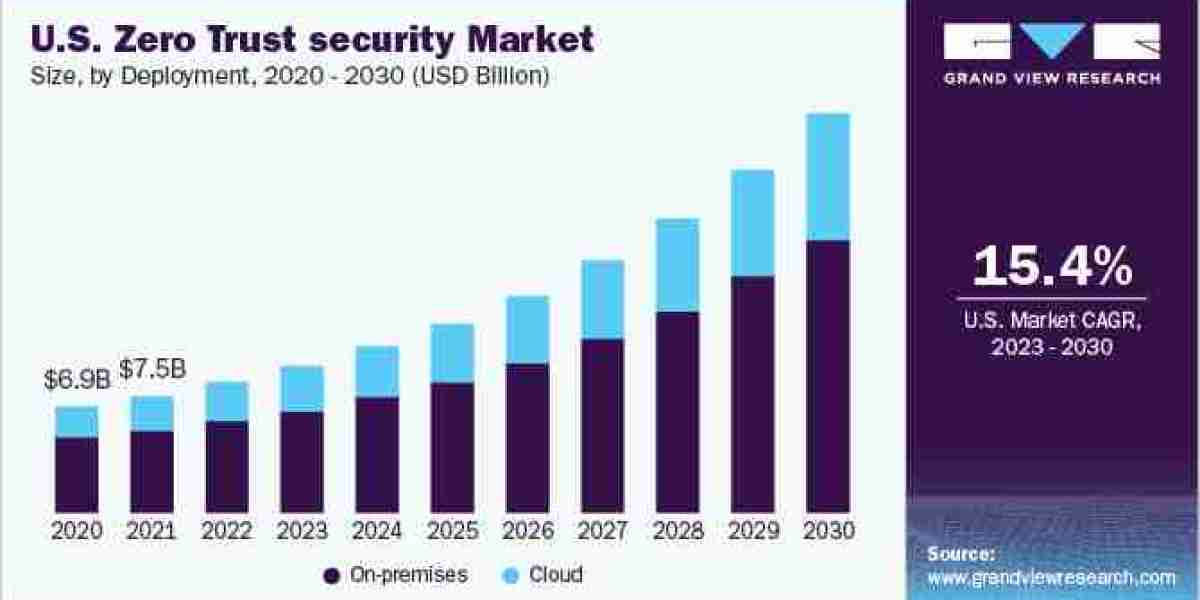

Deployment Insights

By deployment, the cloud segment of the market is projected to witness the highest growth rate of more than 17% over 2023-2030. The growth of the cloud-based segment can be attributed to the comfort and convenience the cloud-based deployment offers, which include the lesser need for in-house resources, less need for upfront costs, continuous monitoring, flexible options, automatic backups, and effective patch management, among others. The flexibility and scalability of the cloud-based deployment have been among the major factors that contributed to the growth of the cloud-based deployment of the market over 2023-2030.

Organization Size Insights

The large enterprise segment accounted for the maximum revenue share of over 76% in 2022 The segment will possess the predominant position throughout 2023-2030, owing to complex networking, programs, and endpoints of large-scale companies that need robust solutions to safeguard data by continuously validating and recording authentication in real-time. Companies rely on only adhering to compliance and entrusting authorized users with a higher risk of an internal breach. The compliant network does not guarantee a secured environment, as the threat to breach is not merely external but also could be by internal trusted sources. The zero-trust security model regards enterprise-authorized users with zero trust and provides the least privileged access to the users.

Authentication Insights

The multi-factor authentication segment led the market in 2022 with a revenue share of more than 75% and will expand at the fastest CAGR from 2023 to 2030. Multi-factor authentication was widely adopted across the industry due to the high level of security from multi-level authorization. The zero trust model’s key component in ensuring robust security is multi-factor authentication. It may be convenient for hackers to identify a single credential factor but multiple levels of verification and monitoring of access in real-time are vital in adhering to the zero-trust security model.

Application Insights

In 2022, the IT and telecom segment accounted for the highest revenue share of more than 45% and was projected to retain the leading position throughout the forecast period. Increased preference for cloud-based infrastructure and digital applications to procure information and facilitate business drives the need for unified, secure access and network solutions. In addition, the telecom industry incumbents primarily provide data transfer services and spend on several security-related technologies. With the increasing awareness about the benefits and applications of zero-trust security, the adoption of this model is expected to grow significantly.

Regional Insights

North America dominated the global market in 2022 accounting for a revenue share of over 36% and is expected to register a significant CAGR from 2023 to 2030. The rising demand for solutions pertaining to the zero-trust security model due to the increasing security spending by the government and public authorities is expected to drive the regional market. Furthermore, the increased adoption of the Internet of Things (IoT), AI, and digital technology by SMEs and large enterprises and the increasing stringency in standards and policies for maintaining data privacy and security are contributing to regional market growth.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

- The global accelerated processing unit market size was estimated at USD 13.85 billion in 2023 and is projected to grow at a CAGR of 17.5% from 2024 to 2030.

- The global IoT in utilities market size was estimated at USD 47.53 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030.

Key Zero Trust Security Companies:

The key players operating in the zero trust security market are broadening their product offerings, and are employing several inorganic growth tactics, such as mergers, partnerships, and acquisitions.

Prominent players dominating the global zero trust security market include:

- Akamai Technologies

- Appgate

- Broadcom

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- CrowdStrike

- Forcepoint

- Fortinet, Inc.

- IBM

- Musarubra US LLC

- Microsoft

- Okta

- Palo Alto Networks

- Zscaler, Inc.

Zero Trust Security Market Segmentation

Grand View Research has segmented the global zero trust security market based on security type, deployment, organization size, authentication, application, and region:

Zero Trust Security Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Network Security

- Data Security

- Endpoint Security

- Cloud Security

- Others

Zero Trust Security Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On-premises

- Cloud

Zero Trust Security Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

- SMEs

- Large Enterprise

Zero Trust Security Authentication Outlook (Revenue, USD Billion, 2018 - 2030)

- Single-factor Authentication

- Multi-factor Authentications

Zero Trust Security Application Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- BFSI

- Healthcare

- Retail

- Others

Zero Trust Security Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.