Artificial Intelligence In Healthcare Industry Overview

The global AI in healthcare market size was estimated at USD 19.27 billion in 2023 and is expected to grow at a CAGR of 38.5% from 2024 to 2030. One primary factor driving market growth is the increasing demand in the healthcare sector for enhanced efficiency, accuracy, and better patient outcomes. According to a March 2024 Microsoft-IDC study, 79% of healthcare organizations are presently utilizing AI technology. In addition, the return on investment (ROI) is realized within 14 months, generating USD 3.20 for every USD 1 invested in artificial intelligence (AI). AI technologies hold transformative potential in various areas including medical imaging analysis, predictive analytics, personalized treatment planning, and drug discovery, potentially transforming conventional healthcare practices.

The exponential growth in healthcare data, sourced from electronic health records (EHRs), medical imaging scans, wearable devices, and genomic sequencing, presents significant opportunities for AI-powered solutions to extract actionable insights and support clinical decision-making. The shortage of healthcare workers is also driving the adoption of AI and machine learning (ML) technologies. According to the World Economic Forum estimates from May 2023, there will be a global health worker deficit of 10 million by 2030. Hence, AI algorithms can be trained to analyze patient health data, aiding care providers in rapid diagnosis and treatment planning. Supportive government initiatives and the COVID-19 impact along with a rise in technological collaborations & M&A activities have contributed to the market's growth and accelerated the adoption of AI in healthcare.

Gather more insights about the market drivers, restrains and growth of the Artificial Intelligence In Healthcare Market

Detailed Segmentation:

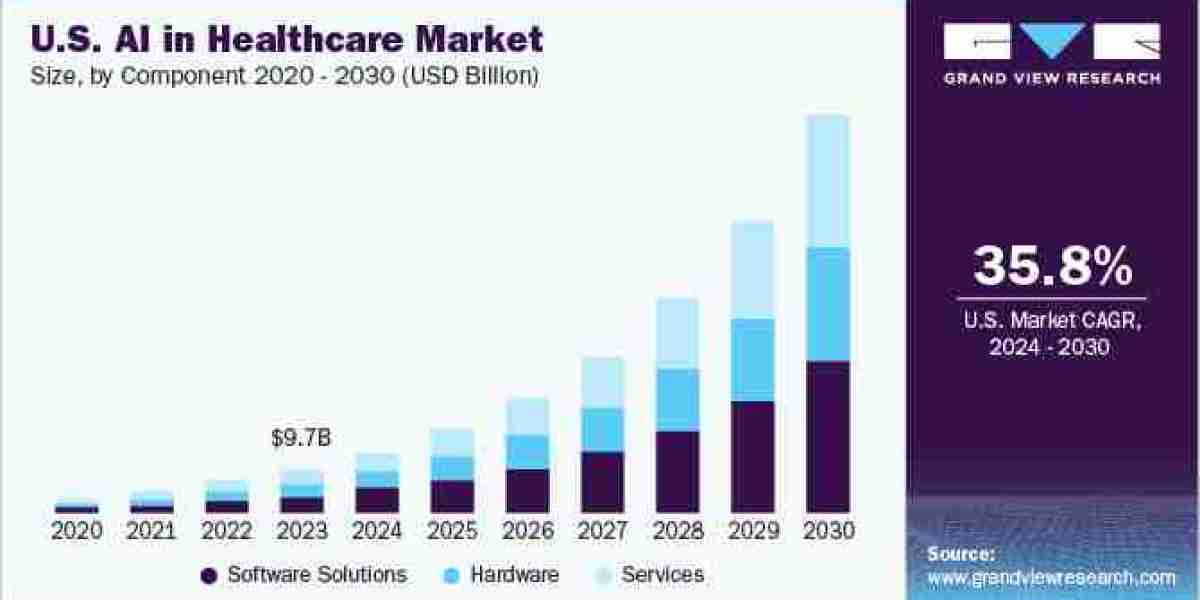

Component Insights

The software solution component segment is anticipated to grow at the fastest CAGR of 38.7% over the forecast period. The segment growth is attributed to the rapidly growing adoption of AI-based software solutions among healthcare providers, payers, and patients. For instance, in September 2019, GE Healthcare partnered with five Chinese local software developers namely, 12Sigma Technologies, Biomind, Shukun Technology, Yizhun Medical AI, and YITU Technology to collaboratively work on developing the Edison AI platform and support the smooth digital transformation of GE Healthcare.

Technology Insights

The M) technology segment held the largest share in 2023. The healthcare industry generates vast amounts of data, including EHRs, medical imaging, genomic data, and wearable device data. Machine learning excels at extracting valuable insights from these large and diverse datasets, enabling healthcare providers to make data-driven decisions and improve patient outcomes. This technology is extensively integrated into healthcare solutions for disease diagnosis, prognosis, and treatment planning. Leveraging patient data patterns and correlations, ML models can detect early disease indicators, forecast patient outcomes, and propose personalized treatment strategies, thereby enhancing the accuracy and timeliness of interventions.

Application Insights

The robot-assisted surgery application segment dominated the market in 2023 with the largest revenue share and is anticipated to witness significant CAGR growth from 2024 to 2030. A rise in the volume of robot-assisted surgeries and increased funding and investment in AI platform development are key drivers propelling AI penetration in this field. For instance, according to a May 2023 Nasdaq, Inc. article, Intuitive Surgical, a leading surgical robotics provider, reported robust Q1 2023 results, with revenue up by 14% YoY to USD 1.7B, driven by a 26% growth in robotics procedures, surpassing expectations by 12 points.

End-use Insights

The healthcare companies segment dominated the market with the largest revenue share in 2023. The widespread adoption of AI technologies in drug development, leveraging genomic information, medical records, and clinical trial data, enables the identification of personalized treatment options and the targeting of therapies to specific patient groups. AI-driven analytics and predictive modeling improve the design, execution, and analysis of clinical trials, resulting in more efficient and cost-effective trials. As per a study by Scilife N.V. in January 2024, approximately 80% of professionals in the pharmaceutical and life sciences sectors utilize AI in drug discovery. Furthermore, research from another study suggests that AI technology reduces the time required by pharmaceutical companies to discover new drugs from 5-6 years to just one year.

Regional Insights

North America AI in healthcare market accounted for the largest revenue share of over 45% in 2023. This can be attributed to advancements in healthcare IT infrastructure, growing care expenditures, widespread adoption of AI/ML technologies, favorable government initiatives, lucrative funding options, and the presence of several key players. Factors, such as growing geriatric population, changing lifestyles, increasing prevalence of chronic disorders, growing demand for value-based care, and rising awareness levels about the implementation of AI-based technologies are further propelling market growth in North America.

Browse through Grand View Research's Category Healthcare IT Industry Research Reports

- The global medical animation market size was valued at USD 396.2 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 20.1% from 2024 to 2030.

- The global cloud-based dental practice management software market size was valued at USD 721.0 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.4% from 2024 to 2030.

Key Companies & Market Share Insights

Market players are utilizing innovative product development strategies, partnerships, and mergers and acquisitions to expand their presence in response to the increasing demand for early and accurate disease detection, cost containment, addressing the shortage of healthcare providers, and providing value-based care.

AI Startup Ecosystem:

The AI healthcare industry is teeming with startups driven by the funding, investment and innovations. These startups leverage AI and machine learning to address various healthcare challenges, from medical imaging and diagnostics to drug discovery and telemedicine.

Key AI In Healthcare Companies:

The following are the leading companies in the AI in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- IBM

- NVIDIA Corporation

- Intel Corporation

- Itrex Group

- GE Healthcare

- Medtronic

- Oracle

- Medidata

- Merck

- IQVIA

AI In Healthcare Market Segmentation

Grand View Research, Inc. has segmented the global AI in healthcare market on the basis of component, application, technology, end-use, and region:

Artificial Intelligence (AI) In Healthcare Component Outlook (Revenue, USD Million, 2018 - 2030)

- Hardware

- Processor

- MPU (Memory Protection Unit)

- FPGA (Field-programmable Gate Array)

- GPU (Graphics Processing Unit)

- ASIC (Application-specific Integrated Circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Software Solutions

- AI Platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On-premise

- Cloud-based

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance Management, etc.)

- AI Platform

- Processor

Artificial Intelligence (AI) In Healthcare Application Outlook (Revenue, USD Million, 2018 - 2030)

- Robot-assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical Devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision Medicine

- Drug Discovery & Development

- Lifestyle Management & Remote Patient Monitoring

- Wearables

- Others (Patient Engagement, etc.)

Artificial Intelligence (AI) In Healthcare Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Machine Learning

- Deep Learning

- Supervised

- Unsupervised

- Others (Reinforcement Learning, Semi-supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text Analytics

- Speech Analytics

- Classification & Categorization

- Context-aware Computing

- Computer Vision

Artificial Intelligence (AI) In Healthcare End-user Outlook (Revenue, USD Million, 2018 - 2030)

- Healthcare Providers (Hospitals, Outpatient Facilities, and Others)

- Healthcare Payers

- Healthcare Companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

Artificial Intelligence (AI) In Healthcare Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In March 2024, Microsoft collaborated with NVIDIA to enhance AI innovation and accelerate computing capabilities. This collaboration leverages Microsoft Azure's global scale and advanced computing along with NVIDIA’s DGX Cloud and Clara suite to accelerate innovation and improve patient care

- In March 2024, NVIDIA introduced new Generative AI Microservices to transform medical technology (MedTech), drug discovery, and digital health. This innovative approach aims to reshape healthcare technology by harnessing advanced AI capabilities