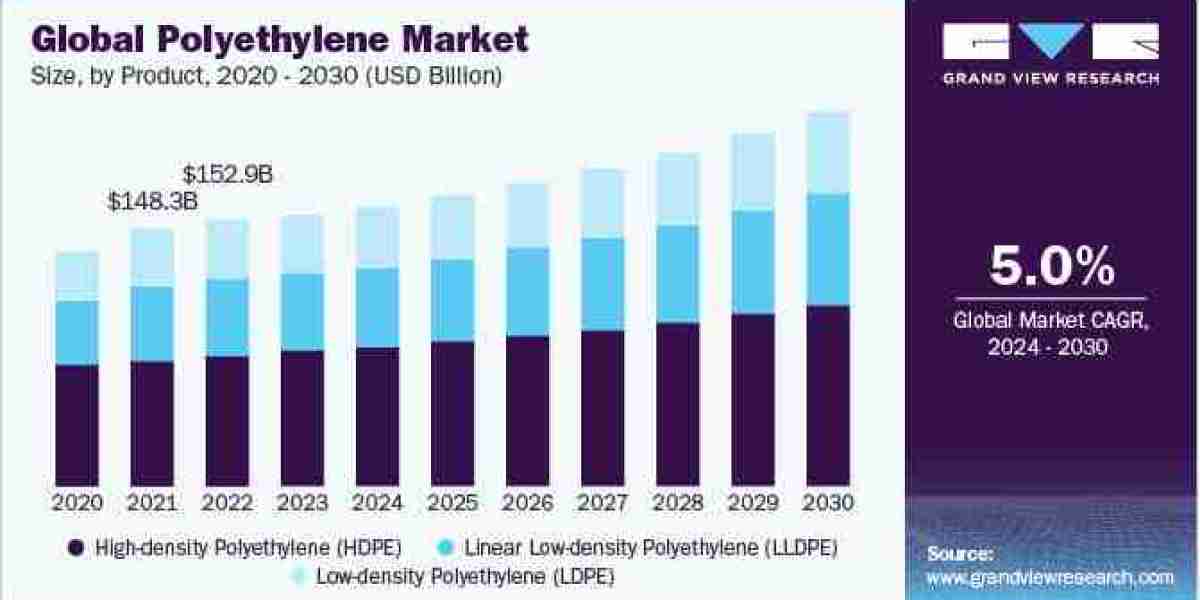

Polyethylene Industry Overview

The global polyethylene market size was estimated at USD 155.18 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. The ongoing technological advancements in several end-use industries and the growing demand for lightweight and cost-effective products are expected to boost market growth over the forecast period. The growth of various end-use industries, such as packaging, construction, and automotive, fuels the demand for virgin polyethylene (PE). As these industries expand globally, the need for high-quality and consistent PE for manufacturing essential products like packaging materials, pipes, and automotive components rises, contributing to market growth.

In addition, population growth and rapid urbanization contribute significantly to the demand for virgin PE. The rising global population, particularly in developing regions, leads to increased consumption of products that utilize PE. Moreover, urbanization drives the need for infrastructure development, including construction projects that rely on PE for various applications. This demographic and societal shift results in a higher demand for virgin PE as a fundamental material in the construction and development processes.

Gather more insights about the market drivers, restrains and growth of the Polyethylene Market

Detailed Segmentation:

Product Insights

In terms of revenue, the high-density polyethylene (HDPE) segment accounted for the largest revenue share of over 49% in 2023. The HDPE segment benefits from the increasing demand for durable and corrosion-resistant materials in construction and infrastructure projects. HDPE's suitability for pipes, geo-membranes, and other construction applications drives its demand.HDPE pipes are widely used for water distribution, irrigation, and drainage systems due to their durability, corrosion resistance, and flexibility. The demand for efficient and long-lasting solutions in water infrastructure and agriculture enhances the growth prospects of the HDPE segment.

End-use Insights

In terms of revenue, the packaging industry led the end-use segment in 2023 with a share of over 52.0%. The extensive use of PE in the production of plastic bags, pouches, and flexible packaging films is driving the segment growth. From food & beverages to pharmaceuticals and consumer goods, PE packaging plays a crucial role in preserving product freshness, extending shelf life, and enhancing the overall visual appeal of products on retail shelves.

Application Insights

In terms of application, the bottles & containers segment led the market in 2023 and accounted for a substantial revenue share of 39.8%. The growth of the bottles & containers segment is driven by the consistent demand for efficient and cost-effective packaging solutions across various sectors, reflecting the adaptability of PE in meeting the diverse packaging needs of these sectors.

Regional Insights

The North America polyethylene market accounted for a significant revenue share of 19.2% in 2023. The shale gas boom in North America has transformed the regional PE market. The abundant and easy availability of cost-effective feedstocks derived from shale gas, particularly ethane, has given PE producers, based in North America, a significant competitive advantage.

Browse through Grand View Research's Category Plastics, Polymers & Resins Industry Research Reports.

- California hot melt adhesives market size was valued at USD 278.7 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030.

- The global poly alpha olefin market size was valued at USD 1.48 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 2.8% from 2024 to 2030.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

- In November 2023, Dow announced an investment in the Fort Saskatchewan Path2Zero project in Alberta, Canada, with an investment of USD 6.5 billion, as part of the company's goal to achieve carbon neutrality by 2050. The project involves the construction of a new ethylene plant and expanding polyethylene capacity by 2 million metric tons annually. The construction is scheduled to commence in 2024, and the increased capacity is set to be implemented in stages, with the initial phase anticipated to begin in 2027

- In October 2023, Borealis AG and TotalEnergies SE announced plans to construct a USD 1.4 billion Borstar PE unit within their Baystar joint venture. This PE unit, boasting a capacity of 625,000 metric tons annually, marks a significant increase, doubling the current production capabilities at the Baystar site including two existing PE production units

- In August 2023, Dow partnered with Mengniu, a dairy company, to launch a PE yogurt pouch, specifically designed for recyclability. This joint effort signifies a significant step for both companies in reinforcing their dedication to promoting a circular economy in China. The partnership with Mengniu enables both brands to take the lead in pioneering recyclable all-PE dairy packaging in the Chinese market.

Key Polyethylene Companies:

The following are the leading companies in the polyethylene market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Borealis AG

- Braskem

- Dow

- Exxon Mobil Corporation

- Formosa Plastics

- INEOS Group

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- MOL Group

- SABIC

- China Petrochemical Corporation (Sinopec)

Polyethylene Market Segmentation

Grand View Research has segmented the global polyethylene market on the basis of product, application, end-use, and region:

PE Product Outlook (Volume, Kilotons, Revenue; USD Million, 2018 - 2030)

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Linear Low-density Polyethylene (LLDPE)

PE Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Bottles & Containers

- Films & Sheets

- Bags & Sacks

- Pipes & Fittings

- Other Applications

PE End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Packaging

- Construction

- Automotive

- Agriculture

- Consumer Electronics

- Other End-uses

PE Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.